Savings are a cornerstone of financial health, and choosing the right savings account can significantly impact how quickly and securely you grow your nest egg. For savvy savers, American Express online savings accounts offer a compelling blend of competitive interest rates, zero fees, robust security, and user-friendly features. But how does it stack up against other options? Let’s dive into everything you need to know about American Express online savings accounts.

Toc

Overview of American Express Online Savings

American Express is a well-known and trusted financial institution, most commonly associated with its credit cards. However, in recent years, American Express has expanded its offerings to include online banking services, including high-yield savings accounts.

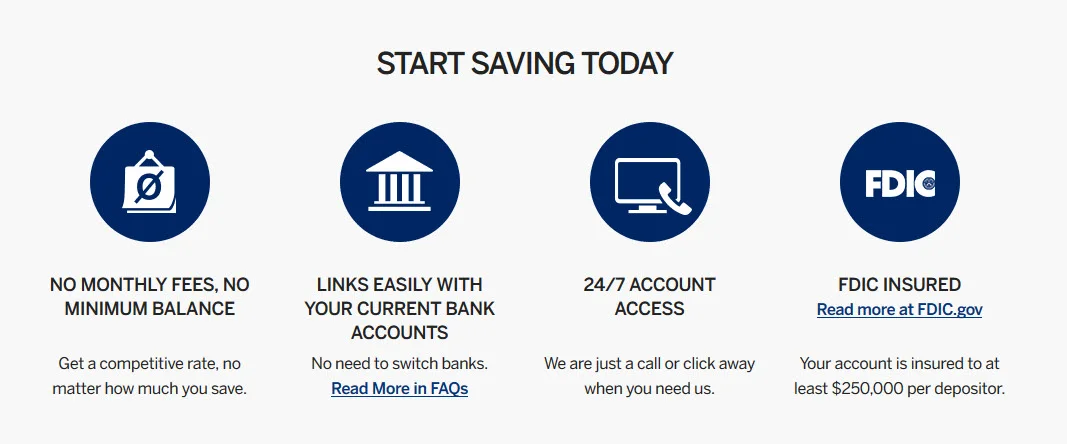

With an American Express online savings account, you can earn a competitive interest rate on your savings while enjoying the convenience and security of online banking. The account is FDIC-insured up to $250,000 per depositor, providing peace of mind for the safety of your funds.

The Benefits of American Express Online Savings

American Express online savings accounts provide a wide range of benefits that make it an attractive option for savvy savers. These include:

- Competitive Interest Rates: American Express offers some of the highest interest rates in the market, allowing your savings to grow even faster.

- Zero Fees: With no monthly maintenance fees or minimum balance requirements, you can keep more of your hard-earned money.

- Security: As a well-established and trusted brand, American Express is known for its robust security measures to protect your personal and financial information.

- User-Friendly Features: The online platform is easy to navigate, making it convenient for users to manage their accounts and track their savings progress.

How American Express Online Savings Work

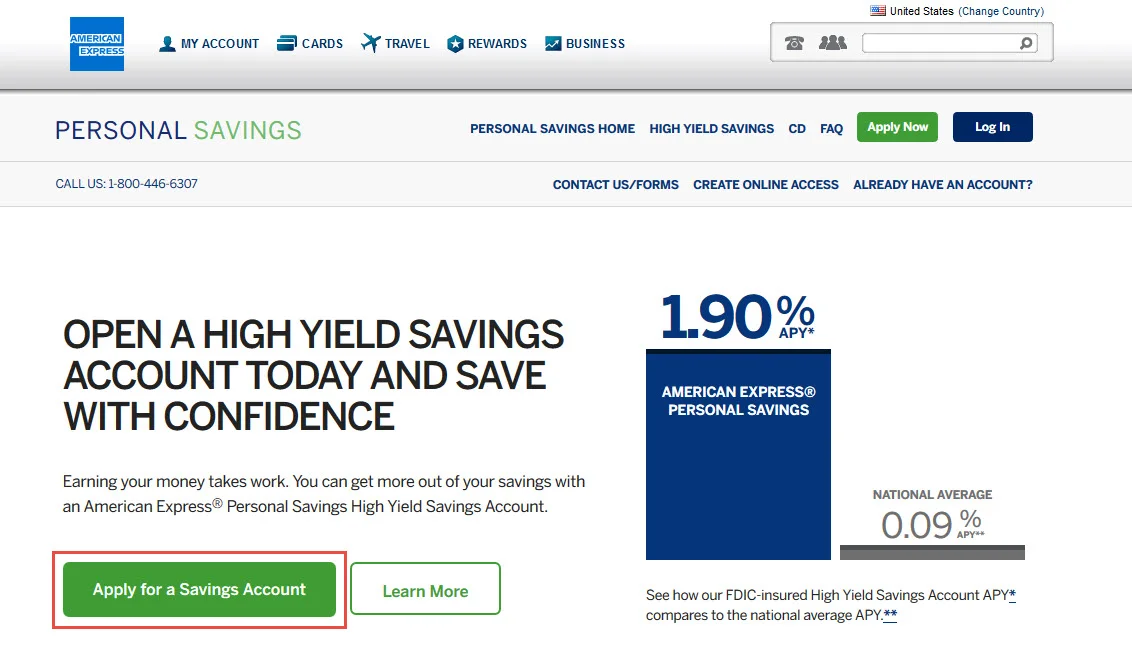

Opening an American Express online savings account is a straightforward process. You can apply online, and once approved, you can fund your account through electronic transfers or by mailing in a check.

Once your account is open, you can set up automatic transfers from another bank account to make saving effortless. You also have the option to deposit checks remotely using the mobile app.

Details of Advantages of American Express Online Savings

Competitive Interest Rates

One of the main draws of American Express online savings accounts is their competitive interest rates. As of November 2021, the account offers a variable APY (Annual Percentage Yield) of 0.40%, which is significantly higher than the national average of 0.05% for savings accounts.

This means that your money will earn more interest in an American Express online savings account compared to a traditional savings account at a brick-and-mortar bank. This can add up over time and help you reach your savings goals faster.

Zero Fees

Another attractive feature of American Express online savings accounts is that they have zero fees. This includes no monthly maintenance fees, no minimum balance requirements, and no transaction fees.

Many traditional banks charge various fees for their savings accounts, which can eat into your earnings. With American Express, you can keep more of your hard-earned money without worrying about these additional costs.

Robust Security Measures

In today’s digital age, security is a top concern for online banking users. American Express takes this seriously and has implemented various measures to ensure the safety of their customers’ information and funds.

All accounts are protected with industry-standard encryption, and they also offer two-factor authentication for added security. In addition, you can set up alerts for any activity on your account to stay informed and quickly address any potential issues.

User-Friendly Features

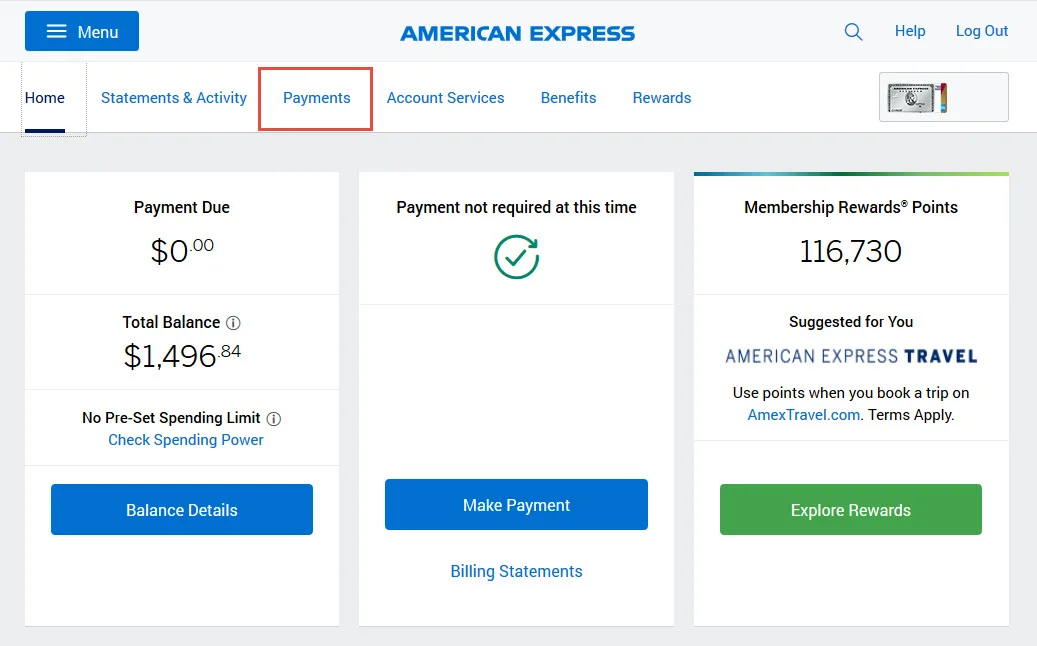

American Express online savings accounts also come with user-friendly features that make managing your money easier. You can easily transfer funds between your American Express accounts or external bank accounts, set up recurring transfers, and track your saving progress through the online dashboard.

In addition, they offer mobile banking options so you can access your account anywhere, anytime. This convenience makes it easy to stay on top of your savings goals and manage your finances effectively.

Is It Right For You?

Ultimately, the decision to open an American Express online savings account comes down to your individual needs and preferences. If you value competitive interest rates, zero fees, strong security measures, and a user-friendly interface, then American Express may be the perfect fit for you. However, if you prioritize other factors such as convenience or specific account features, it’s worth exploring other options in the market.

Competitive Interest Rates: Grow Your Savings Faster

American Express online savings accounts consistently offer some of the highest interest rates in the industry. Unlike traditional banks, which often have lower rates, American Express aims to maximize your savings potential. By opting for a higher interest rate, you’re ensuring that your money works harder for you, accelerating the growth of your savings.

No Monthly Fees: A Cost-Effective Choice

One of the standout features of American Express online savings accounts is the absence of monthly fees. Many banks impose various charges that can eat into your savings over time. With American Express, you can rest easy knowing that your savings won’t be diminished by hidden costs or regular fees. This makes it a cost-effective choice, ensuring that every dollar you deposit remains intact and continues to grow.

Secure and User-Friendly Platform: Access and Manage Your Savings with Ease

Security and ease of use are paramount when it comes to managing your finances online. American Express provides a highly secure, user-friendly online platform that allows you to access and manage your savings 24/7. Its intuitive interface ensures that even those who are not tech-savvy can navigate the platform with ease. Plus, advanced security features and encryption protocols provide peace of mind, knowing your money is safe.

Account Linking: Convenience for Transfers

Another significant advantage of American Express online savings accounts is the convenience of linking your savings account to your existing bank accounts. This feature allows for seamless transfers, making it easier to move money in and out of your savings as needed. Whether you’re saving for a specific goal or need quick access to your funds, this flexibility simplifies the process.

FDIC-Insured: Providing Peace of Mind

Financial security is a top priority for any saver, and American Express delivers with FDIC insurance on their online savings accounts. Your deposits are insured up to the maximum allowed by law, providing an added layer of security. This means you can save with confidence, knowing that your hard-earned money is protected.

American Express vs. Other Online Savings Options

When considering an online savings account, it’s important to compare the options available to find the best fit for your needs. Here’s how American Express stacks up against some of the other popular online savings account providers:

Ally Bank

Ally Bank is another leading choice for online savings accounts, known for its competitive interest rates and no monthly maintenance fees. Ally offers a 24/7 customer service line and a well-regarded mobile app, similar to American Express. However, American Express can edge out Ally Bank with its additional perks such as higher APYs at times and a more extensive range of financial products.

Discover Bank

Discover Bank offers a strong online savings account with no fees and competitive interest rates. They also offer a robust mobile app and excellent customer service. However, American Express often provides higher interest rates and might be more appealing if maximizing interest earnings is your goal. Additionally, American Express’ name recognition and reputation for stellar customer service could provide added peace of mind.

Marcus by Goldman Sachs

Marcus by Goldman Sachs is another competitor that offers high-yield savings accounts with no fees. Marcus often features competitive interest rates and tools for financial planning. While Marcus provides a solid option, American Express stands out with its brand reliability, comprehensive customer support, and rich account features.

In conclusion, American Express online savings accounts present a compelling choice with their competitive interest rates, zero fees, robust security measures, user-friendly platform, seamless account linking, and strong customer support. By providing a well-rounded service, American Express ensures that savers can achieve their financial goals with ease and confidence.

Open an American Express Online Savings Account

If you’re ready to take control of your savings and maximize your earnings, consider opening an American Express online savings account. With a few simple steps, you can open an account and start building towards a stronger financial future.

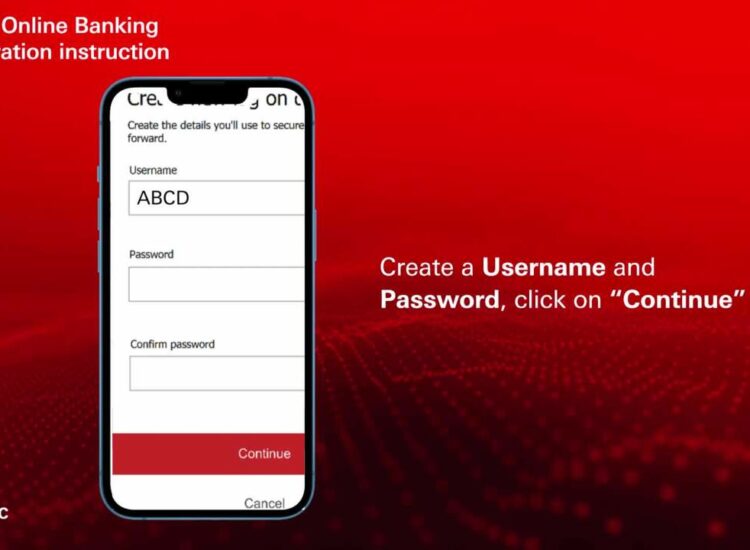

How to Open an American Express Online Savings Account

Opening an American Express online savings account is a straightforward process. Here’s a step-by-step guide:

- Visit the Website: Go to the American Express savings website.

- Apply Online: Click on ‘Open an Account’ and complete the online application form.

- Provide Required Information: Have your Social Security number, a valid ID (like a driver’s license), and details of the bank account you’ll be linking ready.

- Fund Your Account: Make an initial deposit to fund your new savings account.

- Confirm and Submit: Review your information, submit your application, and await confirmation.

Tips for Maximizing Your Savings with American Express

- Set Up Automatic Transfers: Automate your savings by setting up regular transfers from your checking account to your savings account.

- Monitor Your Account: Regularly check your account to track your progress and ensure your savings strategy is on track.

- Take Advantage of High Interest Rates: Keep an eye on interest rate changes and ensure you’re making the most of any increases.

- Utilize the Online Platform: Make use of the American Express online platform tools to set savings goals and track your growth.

- Reinvest Your Interest: Allow your interest to compound by keeping it in your savings account and reinvesting it over time.

Case Studies and Testimonials

Don’t just take our word for it – here are some real-life examples of individuals who have had a positive experience with American Express online savings accounts.

Testimonials

“I have been a loyal American Express cardholder for years, and their online savings account has exceeded my expectations. The convenience of linking my accounts and the high interest rates make managing my money a breeze.” – Sarah, California.

“American Express not only offers competitive interest rates but also provides top-notch customer service. I had an issue with a transfer, and their team resolved it promptly and professionally.” – Mark, New York.

Case Studies

Achieving Savings Goals with American Express

Sara has been saving for a down payment on her first home and was struggling to find the right savings account that offered high interest rates and user-friendly features. After some research, Sara opened an American Express online savings account and started regularly depositing funds. With the help of the platform’s goal-setting tools and the competitive interest rate, Sara was able to reach her savings goal faster than expected.

Peace of Mind in Uncertain Times

John had always been wary of online banking but decided to open an American Express online savings account after reading about their robust security measures. When the pandemic hit and John needed quick access to his emergency funds, he was relieved to see how seamless it was to transfer money from his savings account to his checking account. American Express’ reliable customer service also provided John with added peace of mind during a stressful time.

User Reviews Highlighting FDIC Insurance

Multiple user reviews indicate that the FDIC insurance provided by American Express is a critical factor for many savers. This additional layer of security gives them peace of mind, knowing their money is protected. One user wrote, “I appreciate the peace of mind that comes with FDIC insurance. It’s reassuring to know that my savings are safe and secure with American Express.” This emphasis on security is a testament to American Express’ commitment to providing a reliable and trustworthy online savings experience for its customers.

Conclusion

American Express online savings accounts provide a powerful combination of competitive interest rates, no monthly fees, robust security, and user-friendly features. Whether you’re a young professional looking to grow your savings, a seasoned saver seeking convenience and peace of mind, or a family safeguarding your financial future, American Express offers a smart and secure solution.

Ready to take the next step in maximizing your savings? Consider opening an American Express online savings account today and experience the benefits firsthand. Remember, the key to financial success is making informed decisions, and with American Express, you’re well on your way to a brighter financial future.