The financial landscape has evolved significantly over the years, shifting from traditional banking methods to more innovative, digital solutions. One such innovation is the advent of online personal loans, which offer a modern alternative to conventional lending practices. These loans come with a multitude of benefits, making them an attractive option for many personal finance seekers.

Toc

- 1. Overview of Online Personal Loans

- 2. The Convenience of Applying from Home

- 3. Finding the Best Online Personal Loans

- 4. Competitive Interest Rates

- 5. Flexibility in Repayment Terms

- 6. Accessibility and No Collateral Requirement

- 7. Transparent Fee Structures and Terms

- 8. Credit Building and Improvement Opportunities

- 9. Case Studies and Testimonials

- 10. Conclusion

In this article, we’ll dive into the best online personal loans, highlighting their key benefits such as quick application processes, competitive interest rates, flexible repayment terms, and more. Whether you’re looking to consolidate debt, cover unexpected expenses, or finance a home improvement project, online personal loans can be a viable solution.

Overview of Online Personal Loans

Online personal loans are designed to provide borrowers with a seamless and efficient borrowing experience. The entire process, from application to disbursement, can typically be completed online, often within a matter of hours. This convenience eliminates the need for in-person visits to a bank or credit union, saving you valuable time.

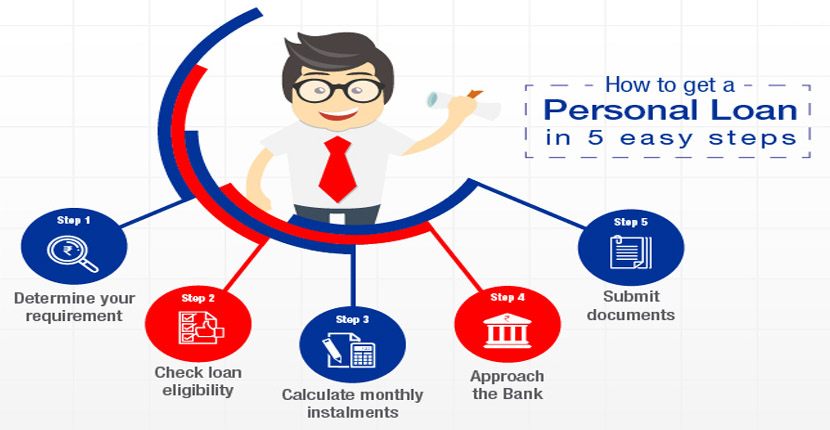

How Online Personal Loans Work?

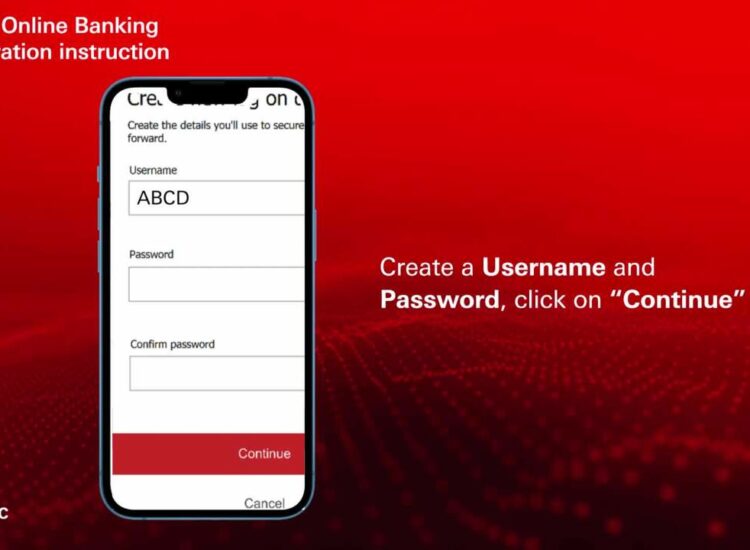

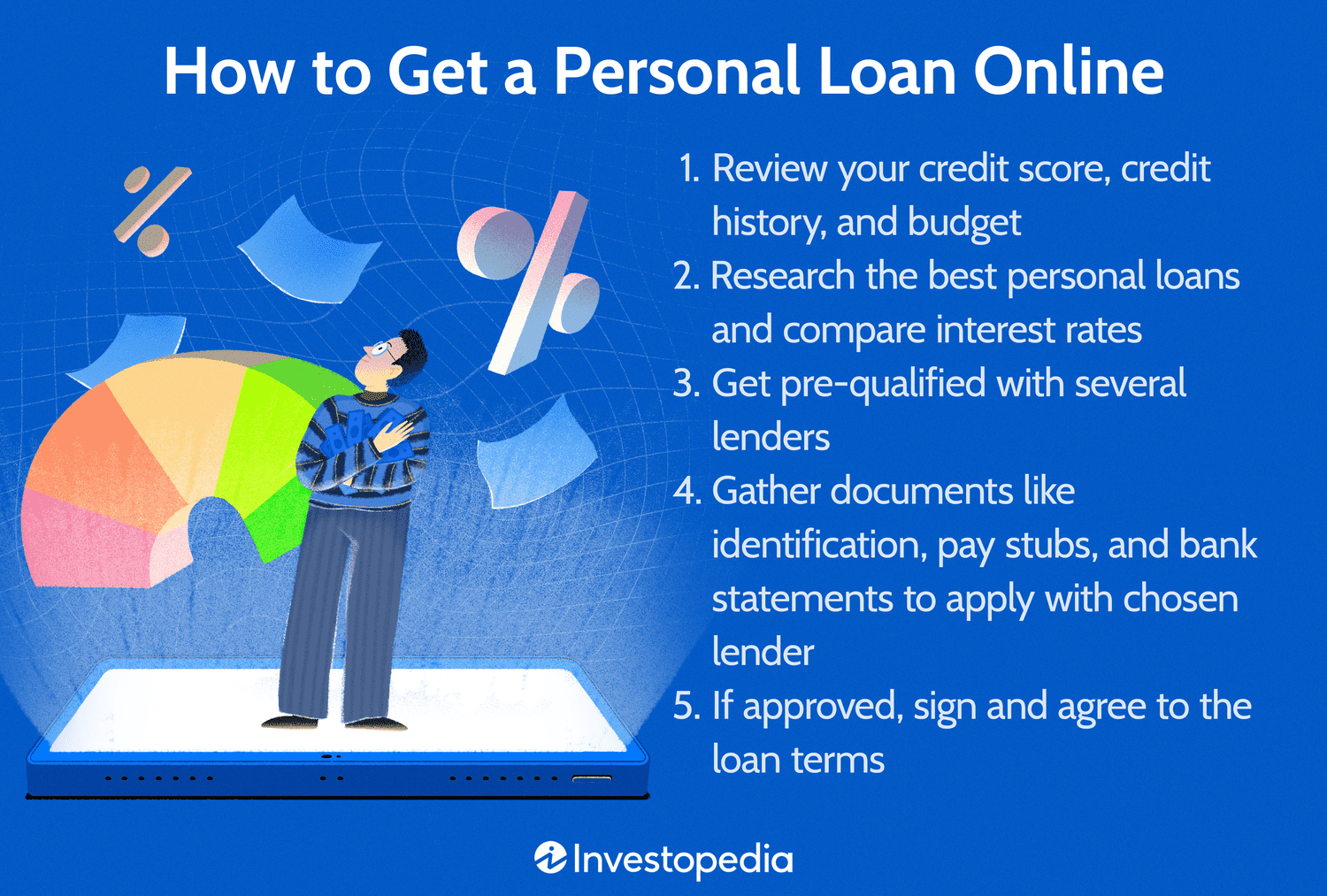

To apply for an online personal loan, you’ll typically need to fill out an application form through the lender’s website. This form will ask for personal and financial information, such as your income, employment status, credit score, and desired loan amount. Some lenders may also require additional documentation, such as bank statements or pay stubs.

Once you submit your application, the lender will review it and determine if you qualify for a loan. If approved, you’ll receive a loan offer outlining the terms and conditions of your loan. These typically include the interest rate, repayment term, monthly payment amount, and any fees associated with the loan.

If you accept the offer, you’ll be asked to electronically sign the loan agreement. After that, funds are usually disbursed directly into your bank account, often within one to two business days. From there, you’ll make regular payments according to the terms of the loan until it is paid off.

Benefits of Online Personal Loans

- Quick Application Process: One of the standout features of online personal loans is the speed at which you can complete your application. With user-friendly interfaces and straightforward forms, applying for a loan could take just a few minutes.

- Competitive Interest Rates: Many online lenders offer competitive interest rates tailored to your creditworthiness. This can result in significant savings over the life of your loan compared to traditional banking options.

- Flexible Repayment Terms: Online personal loans often come with a variety of repayment terms, allowing you to choose a repayment schedule that fits your financial situation. This flexibility can make it easier to manage your monthly budget.

- Transparency and No Hidden Fees: Reputable online lenders are transparent about their fees and rates. This means you are less likely to encounter hidden charges, ensuring you have a clear understanding of what you owe.

- Access to a Wide Range of Lenders: The internet provides access to a multitude of lenders, increasing your chances of finding a loan that meets your specific needs. This variety also fosters competition among lenders, which can be beneficial for borrowers seeking favorable terms.

- Improved Credit Score: Successfully managing an online personal loan and making timely repayments can help improve your credit score. This can open doors to better financial opportunities in the future.

In the next sections, we’ll explore some of the best online personal loan providers, detailing their specific offerings and what sets them apart from the competition.

The Convenience of Applying from Home

One of the primary reasons people turn to online personal loans is the convenience they offer. With no need to visit a physical location, you can apply for a loan from the comfort of your own home. This eliminates the stress and hassle of scheduling appointments and allows you to complete the process at your own pace.

How Online Applications Work

One of the most significant advantages of online personal loans is the ease of application. Instead of scheduling an appointment at a bank and waiting in line, you can apply for a loan from the comfort of your home. The process typically involves filling out a digital form with basic information such as your name, income, employment details, and the amount you wish to borrow.

Advantages of the Digital Application Process

The digital application process is not only convenient but also time-efficient. Most online lenders offer instant pre-approval, allowing you to know whether you’re eligible for a loan within minutes. Moreover, the entire process can often be completed in less than an hour, eliminating the need for multiple trips to the bank. This streamlined process saves time and effort, making online personal loans an excellent option for those seeking quick financing solutions.

Finding the Best Online Personal Loans

Now that we’ve covered the basics of online personal loans, it’s time to explore some of the top providers in the market. Below are a few reputable lenders offering competitive rates, flexible terms, and a seamless borrowing experience.

1. SoFi

SoFi is one of the most renowned names in the world of online personal loans. They offer both fixed and variable rate options with no origination fees or prepayment penalties. SoFi also stands out for its unique member benefits program, which includes career coaching, financial planning resources, and exclusive member events.

2. Marcus by Goldman Sachs

Marcus by Goldman Sachs is another top option for online personal loans. They offer fixed-rate loans with no fees and the ability to change your payment due date up to three times during the life of the loan. Additionally, borrowers have access to their credit score for free and can request a deferment of one payment per year.

3. Best Egg

Best Egg stands out for its quick application process, with many borrowers receiving funds within one business day. Their competitive interest rates and flexible repayment terms make them an attractive option for those seeking a hassle-free borrowing experience.

Competitive Interest Rates

When it comes to online personal loans, interest rates can vary significantly depending on factors such as your credit score and income. However, overall, online lenders tend to offer competitive rates compared to traditional banks.

Comparison with Traditional Banks

Online lenders often offer more competitive interest rates compared to traditional banks. This is primarily because online lenders operate with lower overhead costs, which allows them to pass on the savings to borrowers. According to a study by the Consumer Financial Protection Bureau, online personal loans can sometimes have interest rates that are several percentage points lower than those offered by conventional banks.

Securing the Best Rates

Several factors affect the interest rates on online personal loans. These include your credit score, income, and the loan amount. To secure the best rates, it’s advisable to shop around and compare offers from multiple online lenders. Additionally, maintaining a good credit score can significantly improve your chances of getting a low-interest rate. Make sure to check your credit report for any errors that could be impacting your score and take steps to improve it before applying for a loan.

Flexibility in Repayment Terms

Another significant advantage of online personal loans is the flexibility they offer in terms of repayment. Below are some ways in which this flexibility can benefit borrowers.

Overview of Repayment Options

Another key benefit of online personal loans is the flexibility in repayment terms. Most online lenders offer a variety of repayment options, ranging from a few months to several years. This flexibility allows you to choose a repayment schedule that best suits your financial situation.

Importance of Choosing Suitable Terms

Selecting a loan with appropriate repayment terms is crucial for managing your finances effectively. For instance, opting for a longer repayment term can lower your monthly payments but may result in higher interest costs over the life of the loan. Conversely, a shorter repayment term can save you money on interest but will require higher monthly payments.

Accessibility and No Collateral Requirement

Online personal loans are unsecured, meaning they do not require collateral. This makes them accessible to a wider range of borrowers, including those who may not have assets to use as security for traditional bank loans. Additionally, online lenders often have less stringent credit requirements compared to banks, making it easier for individuals with lower credit scores to secure financing.

Wider Audience Accessibility

Online personal loans are generally more accessible to a broader audience. Many online lenders offer loans to individuals with varying credit profiles, making it easier for people who may not qualify for traditional bank loans to secure funding.

No Collateral Needed

Most online personal loans are unsecured, meaning they do not require collateral. This feature makes them an attractive option for those who may not have assets to pledge. The absence of collateral also simplifies the application process, reducing the time and paperwork involved.

Transparent Fee Structures and Terms

One concern with traditional bank loans is the potential for hidden fees and charges. However, most online lenders have transparent fee structures and terms, making it easier for borrowers to understand the true cost of their loan.

Clarity of Fees and Terms

Transparency is another hallmark of online personal loans. Reputable online lenders provide clear and straightforward information about their fee structures and terms. This transparency ensures that borrowers fully understand the cost of the loan, including any origination fees, late payment penalties, or prepayment charges.

Importance of Understanding Costs

Understanding the full cost of the loan before borrowing is essential for making informed financial decisions. Always read the fine print and ask questions if any terms are unclear. Knowing the total cost of the loan upfront can help you avoid any unpleasant surprises down the road.

Credit Building and Improvement Opportunities

For those looking to improve their credit score, taking out a personal loan and making timely payments can help build positive credit history. Many online lenders report borrower’s payment activity to credit bureaus, providing an opportunity for individuals with no or poor credit to establish or improve their credit scores.

Positive Impact on Credit Scores

Timely repayments on online personal loans can have a positive impact on your credit score. By consistently making payments on time, you demonstrate financial responsibility, which can improve your credit rating over time.

Tips for Credit Building

If you’re looking to use an online personal loan to build or improve your credit, here are a few tips:

- Make Timely Payments: Ensure that you make all your loan payments on time to avoid late fees and negative marks on your credit report.

- Monitor Your Credit: Regularly check your credit report to track your progress and identify any errors that may need correction.

- Avoid Over-Borrowing: Only borrow what you need and can afford to repay. Taking on too much debt can negatively impact your credit score and financial health.

Case Studies and Testimonials

To further illustrate the benefits of online personal loans, here are some real-life examples from satisfied borrowers:

John’s Debt Consolidation Success

John, a 35-year-old marketing manager, used an online personal loan to consolidate his credit card debt. By securing a loan with a lower interest rate, he was able to reduce his monthly payments and simplify his finances. Within a year, John’s credit score improved significantly, and he was impressed by the transparent terms and quick approval process.

Sarah’s Freelancer Journey

Sarah, a freelancer, faced unexpected business expenses that threatened her operations. An online personal loan provided the quick funding she needed to cover these costs. The flexible repayment terms aligned perfectly with her irregular income, allowing her to manage her finances without stress. Sarah appreciated the convenience and speed of the online application process.

Mark’s Home Improvement Project

Mark decided to finance a home improvement project with an online personal loan. He found the application process straightforward and was pleased with the competitive interest rates compared to traditional lenders. The loan allowed him to complete his project on time, and he found managing the loan online incredibly convenient.

Conclusion

Online personal loans offer a plethora of benefits, making them an excellent option for anyone looking to manage their finances more effectively. From quick and convenient applications to competitive interest rates and flexible repayment terms, the advantages are numerous.

If you’re considering a personal loan, exploring online options could be your best bet. Not only do they offer transparency and accessibility, but they also provide opportunities to build or improve your credit score.