In today’s financial landscape, maintaining a healthy credit score is crucial. Whether you’re looking to secure a mortgage, obtain a credit card, or simply ensure your financial well-being, understanding and monitoring your credit score is essential. Enter the Credit Karma app, a powerful tool designed to help users track their credit scores, receive personalized financial recommendations, and access various financial services—all for free.

Toc

- 1. Introduction of Credit Karma App

- 2. How to Use Credit Karma App

- 3. Monitoring and Protection Features

- 4. Access to Financial Services

- 5. Comparison with Similar Apps

- 6. How to Use the Credit Karma App

- 6.1. Step 1: Download and Install the App

- 6.2. Step 2: Set Up Your Profile

- 6.3. Step 3: Review Your Credit Scores

- 6.4. Step 4: Monitor Your Credit Reports

- 6.5. Step 5: Explore Personalized Recommendations

- 6.6. Step 6: Utilize Financial Tools

- 6.7. Step 7: Discover Financial Products

- 6.8. Step 8: Stay Secure

- 7. Conclusion

- 8. FAQs

Introduction of Credit Karma App

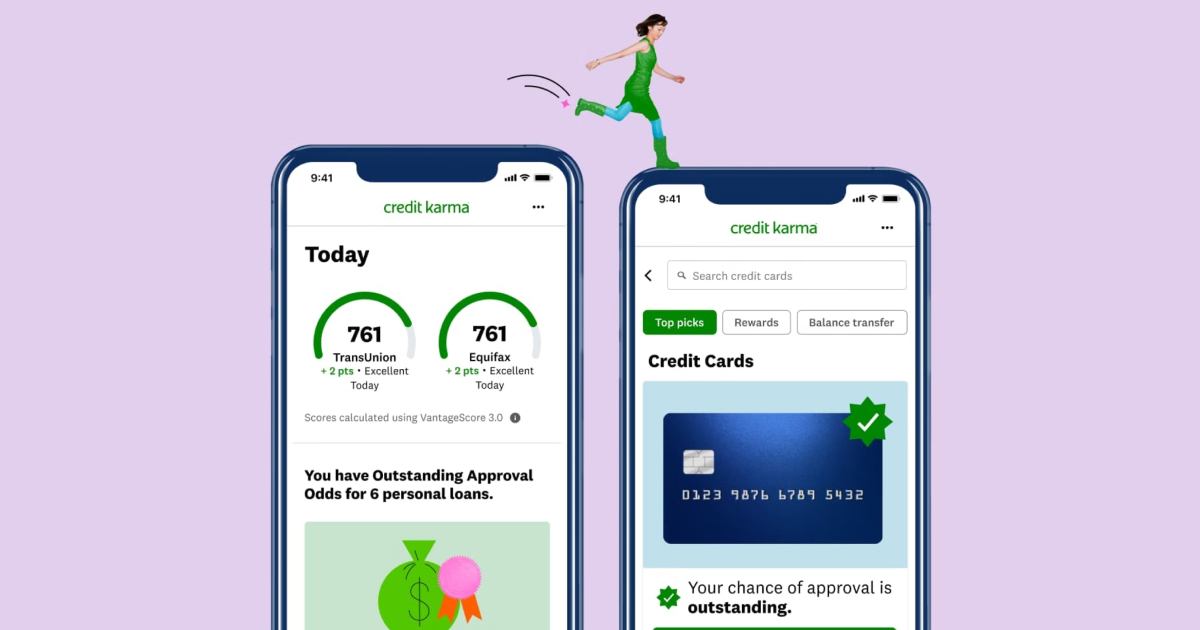

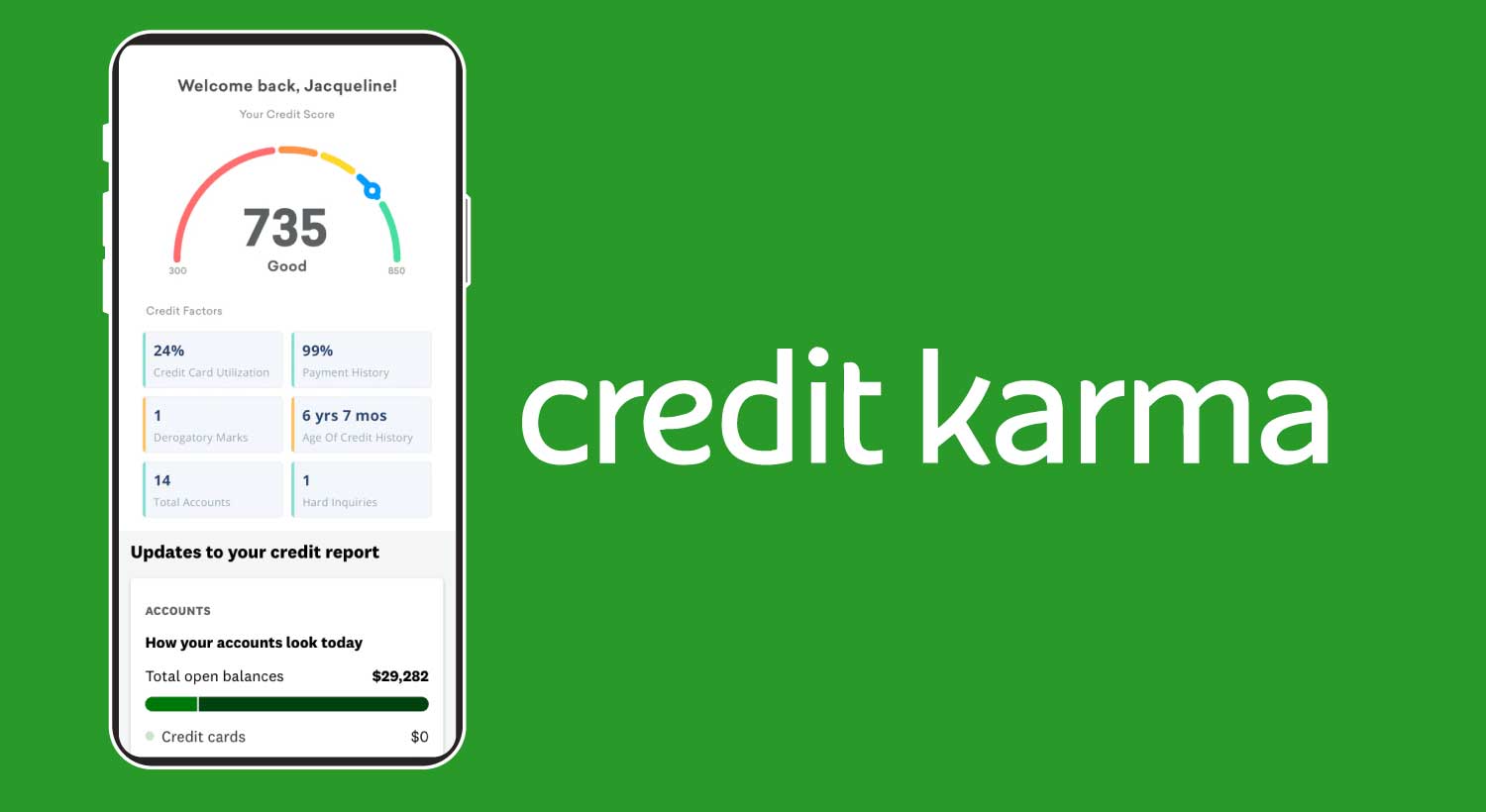

The Credit Karma app offers a user-friendly interface that simplifies the complexities of credit management. Whether you are a financial novice or an expert, the app provides valuable insights tailored to your unique credit profile. Upon downloading and setting up the app, users are granted free access to their credit scores from two major credit bureaus: TransUnion and Equifax. Additionally, the app allows you to view your credit report, track changes over time, and receive alerts for any significant updates or potential discrepancies.

One of the standout features of Credit Karma is its personalized recommendations. Based on your credit profile, the app suggests credit cards, loans, and other financial products that best match your needs and likelihood of approval. Moreover, Credit Karma offers an array of educational resources, such as articles and calculators, to help users understand the factors influencing their credit scores and make informed financial decisions. Its commitment to providing these services at no cost makes Credit Karma a key ally for anyone looking to build or maintain a strong credit history.

Benefits of Using Credit Karma App

- Free Credit Score Monitoring: As mentioned, the app allows users to view their credit scores from two major bureaus for free. This feature not only provides convenience but also saves you money that would typically be spent on obtaining your credit report.

- Personalized Recommendations: With its advanced algorithms, Credit Karma offers personalized recommendations for financial products, making it easier for users to find suitable options without damaging their credit score with multiple applications.

- Educational Resources: The app’s extensive library of articles and calculators empowers users to understand the factors impacting their credit scores and make informed decisions about their finances.

- Credit Score Improvement Tools: Along with monitoring and educational resources, Credit Karma also offers tools and tips to help users improve their credit scores, such as debt repayment calculators and personalized credit score simulators.

How Credit Karma Works to Protect Your Data

With the increase in cyber threats, it’s natural to be concerned about the safety of your personal information when using a financial app. Credit Karma takes several steps to ensure the security and privacy of its users’ data:

- Encryption: The app uses 128-bit or higher encryption to protect all user data.

- Multi-Factor Authentication: Users are required to verify their identity through multi-factor authentication each time they log in, reducing the risk of unauthorized access.

- Strict Privacy Policies: Credit Karma has strict policies in place for how user data is collected, stored, and shared with third parties.

How to Use Credit Karma App

To fully utilize the features of Credit Karma, follow these steps:

- Download the app from your device’s app store.

- Sign up for an account using your personal information.

- Verify your identity by answering a few security questions.

- Connect any relevant financial accounts (e.g., credit cards, loans) to get a more accurate representation of your credit profile.

- Explore the various features of the app, such as viewing your credit report and score, receiving personalized recommendations, and accessing educational resources.

- Utilize the tools and tips provided by Credit Karma to improve your credit score.

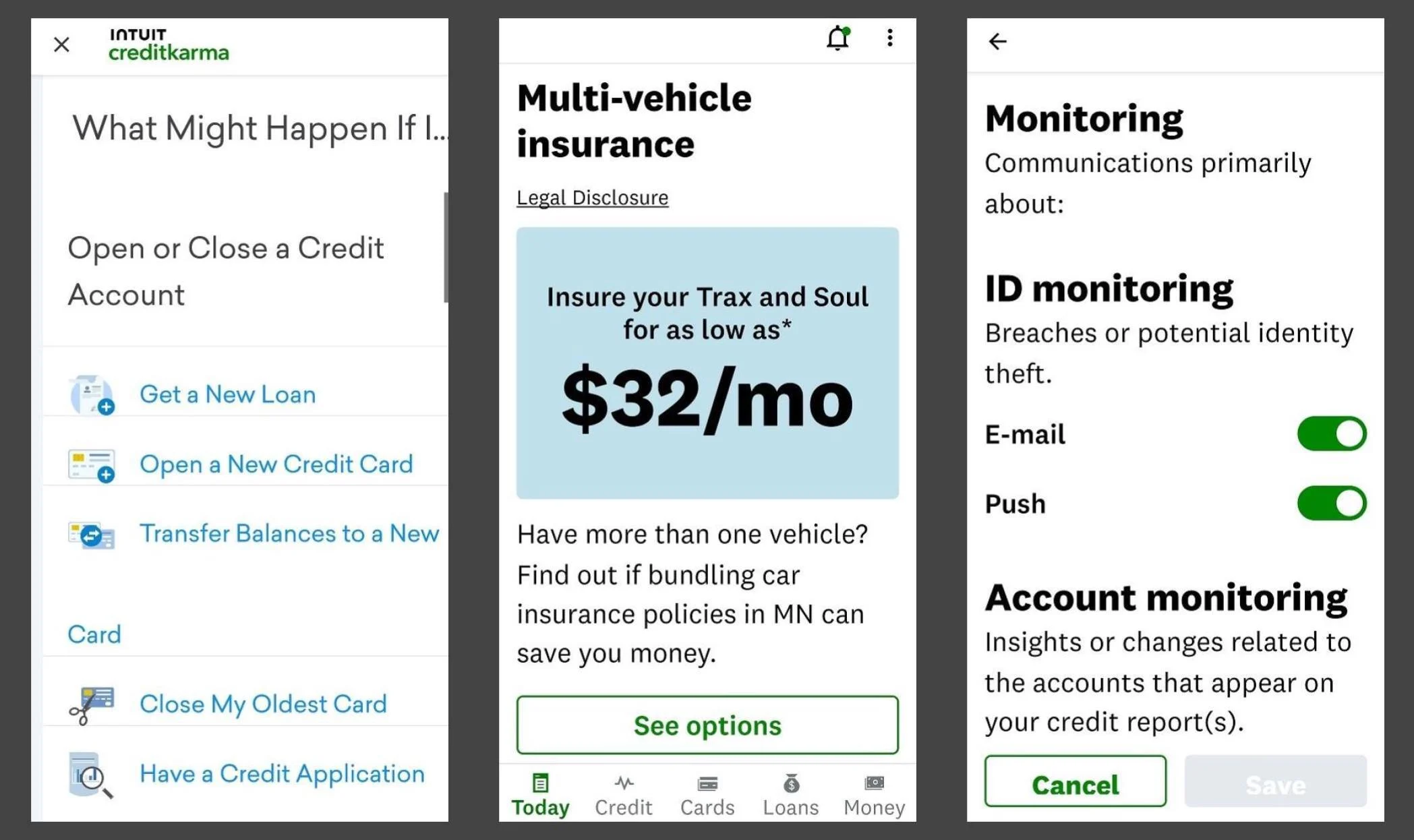

Monitoring and Protection Features

Apart from providing access to credit scores and recommendations, Credit Karma also offers several monitoring and protection features to its users. These include:

- Credit Report Monitoring: The app checks your credit report daily for any significant changes or discrepancies.

- Credit Score Alerts: You can set up alerts to be notified of any significant changes in your credit score, allowing you to take immediate action if necessary.

- Identity Theft Protection: Credit Karma provides identity theft insurance of up to $50,000 and assists with identity restoration services in case of fraud or theft.

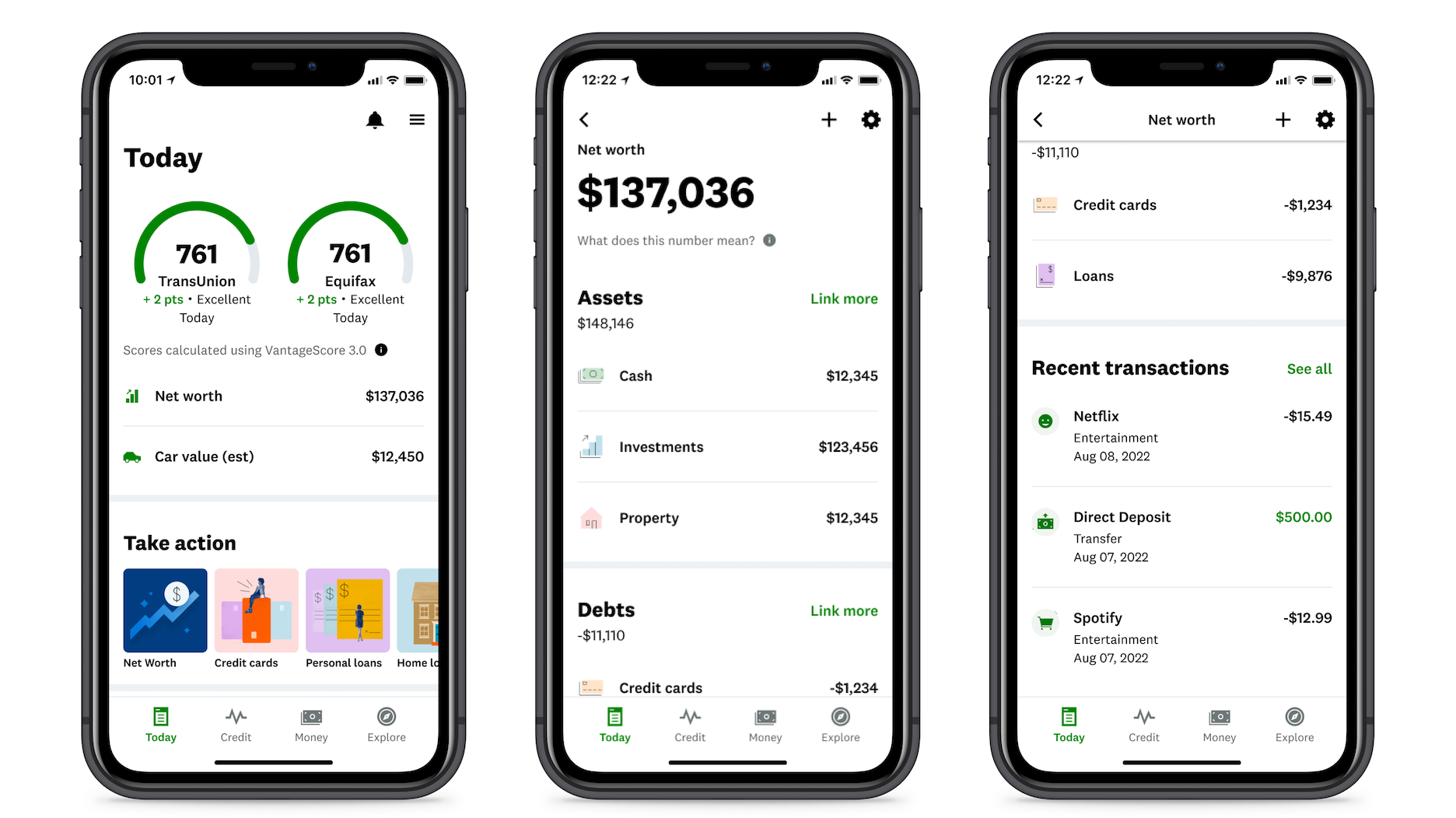

Free Credit Score Tracking

One of the standout features of the Credit Karma app is its free credit score tracking. Unlike many other services that require a subscription, Credit Karma provides users with free access to their credit scores from two major credit bureaus: TransUnion and Equifax. Users can check their scores regularly without any impact, enabling them to stay informed about their credit health.

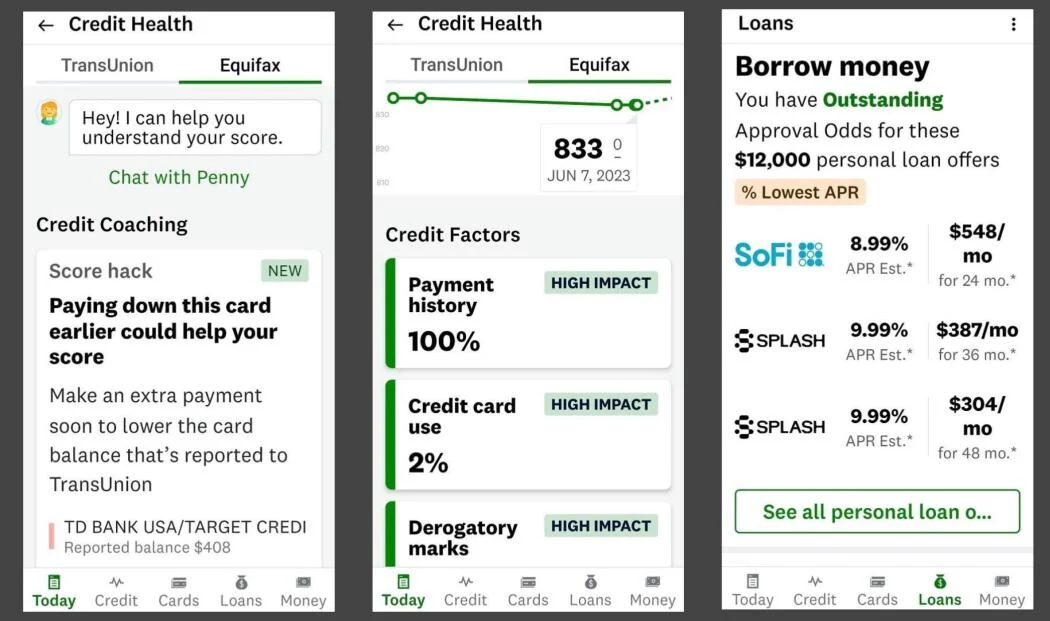

Personalized Financial Recommendations

Credit Karma goes beyond merely displaying your credit score. The app offers personalized recommendations aimed at improving your credit standing. By analyzing your financial profile, Credit Karma suggests actions you can take to boost your score. These recommendations might include tips on reducing debt, opening new credit lines responsibly, or addressing any negative marks on your report.

Credit Monitoring Tools

Credit Karma equips users with robust credit monitoring tools. These tools allow you to monitor changes to your credit report, including new accounts, inquiries, and potential errors. You’ll receive alerts for significant changes, helping you stay on top of your credit status and address any discrepancies promptly.

Security Features

In an age where data breaches are increasingly common, security is paramount. Credit Karma offers comprehensive security features to protect your sensitive information. The app uses advanced encryption technologies and adheres to strict privacy protocols to ensure your data remains secure. Additionally, Credit Karma monitors for identity theft and provides resources to help you recover if your identity is compromised.

Access to Financial Services

Credit Karma also offers access to various financial services, such as credit cards, loans, and insurance. These services are tailored to your credit profile and can help you find suitable options without affecting your score negatively. This feature makes Credit Karma a one-stop-shop for all your financial needs.

Variety of Financial Services

Credit Karma isn’t just about tracking your credit score; it also provides access to a range of financial services. The app offers tools to help you find the best credit cards, loans, and insurance products tailored to your financial situation. Users can also connect their bank accounts to track their spending and set budgets, making it easier to stay on top of your finances.

Convenience and Cost Savings

One of the most significant benefits of using Credit Karma is the convenience it provides. With all your financial information in one place, you can easily monitor your credit health, track your spending, and access personalized recommendations without having to switch between various apps or services. Plus, with its free features and resources, Credit Karma saves you money that would typically be spent on similar services.

Credit Card and Loan Recommendations

One of the most valuable aspects of Credit Karma is its credit card and loan recommendations. Based on your credit profile, the app suggests credit cards and loans that you have a high likelihood of approval for. This feature can save you time and increase your chances of being approved, as it matches you with offers suited to your credit history and needs.

Comparison with Similar Apps

While Credit Karma offers a comprehensive set of features and resources, it’s not the only app on the market that provides credit tracking and financial guidance. Here’s how Credit Karma stacks up against some similar apps:

Credit Sesame

Credit Sesame is another popular app for credit monitoring. Like Credit Karma, it offers free access to your credit score and provides personalized recommendations. However, Credit Sesame only provides your score from TransUnion, whereas Credit Karma offers scores from both TransUnion and Equifax.

Experian

Experian provides free credit score tracking but requires a subscription for detailed credit report access and monitoring services. While Experian’s app offers robust features, including identity theft protection and advanced analytics, its paid model can be a drawback for users seeking free services.

NerdWallet

NerdWallet offers free credit score tracking and personalized recommendations, much like Credit Karma. However, unlike Credit Karma, NerdWallet does not provide access to your credit report or offer monitoring services. It also lacks the variety of financial products and services available through Credit Karma.

How to Use the Credit Karma App

Navigating the Credit Karma app is straightforward, making it accessible for users of all tech proficiency levels. Here’s a step-by-step guide to help you make the most of its features:

Step 1: Download and Install the App

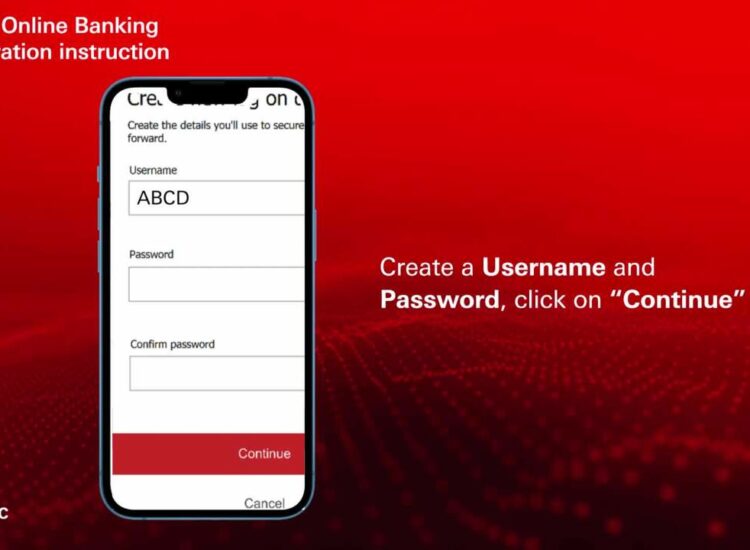

Begin by downloading the Credit Karma app from your device’s app store. It’s available for both iOS and Android platforms. Once downloaded, open the app and proceed to create an account by providing your email address and creating a strong password.

Step 2: Set Up Your Profile

After account creation, complete your profile by entering personal information such as your full name, date of birth, and Social Security Number. This data is required to securely access your credit information.

Step 3: Review Your Credit Scores

Once your profile is set up, you will be able to view your credit scores from TransUnion and Equifax directly on the app’s dashboard. Click on each score to see a detailed breakdown of what factors are affecting your credit and where you might improve.

Step 4: Monitor Your Credit Reports

Navigate to the ‘Credit Monitoring’ section to review your credit reports. Make a habit of checking this section regularly for any discrepancies or unfamiliar activities. The app will send alerts for significant changes, which you should address promptly.

Step 5: Explore Personalized Recommendations

Visit the ‘Recommendations’ tab to view tailored advice on how to improve your credit score. These suggestions are based on your current financial profile and credit behaviour, providing specific actions you can take.

Step 6: Utilize Financial Tools

Make use of Credit Karma’s financial tools by linking your bank accounts. This can help you track spending, set budgeting goals, and receive insights into managing your money more effectively.

Step 7: Discover Financial Products

Explore the app’s ‘Financial Products’ section to find credit cards, loans, and insurance products that are suited to your credit profile. Use the filters and compare options to find the best deals without impacting your credit score.

Step 8: Stay Secure

Credit Karma takes your security seriously. Ensure that your app settings are configured to protect your data – enable two-factor authentication and review the app’s privacy settings periodically.

By following these steps, you can maximize the benefits of the Credit Karma app and take control of your financial health with confidence.

Conclusion

The Credit Karma app offers a range of benefits for anyone looking to take control of their credit health. From free credit score tracking to personalized financial recommendations and access to a variety of financial services, Credit Karma stands out as a valuable tool for credit builders. Its robust monitoring and security features, coupled with positive user reviews, make it a trustworthy choice for managing your credit.

Ready to take charge of your credit journey? Download the Credit Karma app today and start your path towards better financial health. Have feedback or experiences to share? We’d love to hear from you in the comments below!

FAQs

Q: Is the Credit Karma app really free?

A: Yes, Credit Karma provides completely free access to your credit scores from both TransUnion and Equifax. In addition to credit scores, the app offers personalized financial recommendations and various financial services, all at no cost. This makes it an excellent tool for anyone looking to monitor and improve their credit health without having to pay for expensive services.

Q: How often does Credit Karma update my credit score?

A: Credit Karma updates your credit scores weekly, giving you the ability to stay informed about any changes or fluctuations. This frequent updating can help you track your progress, catch any inaccuracies, and make informed decisions about your financial wellbeing in a timely manner.

Q: How secure is my data with Credit Karma?

A: Credit Karma uses advanced encryption technologies and follows strict privacy protocols to ensure your data remains secure. The company adheres to industry standards for data protection, ensuring that your personal information is safeguarded against unauthorized access and breaches. You can feel confident that your sensitive information is in good hands.

Q: Can using Credit Karma affect my credit score?

A: No, checking your credit score with Credit Karma does not impact your credit score. This is considered a “soft inquiry,” which has no effect on your credit rating. However, applying for credit cards or loans recommended by Credit Karma may result in a “hard inquiry” on your credit report, which can temporarily lower your score. Therefore, it’s essential to be selective and only apply for offers that you are likely to be approved for. Additionally, keeping an eye on your credit health through the app can help you identify and address any potential issues before they have a significant impact on your score, thereby helping you maintain a better credit history over time.

Q: Can I access Credit Karma from my desktop?

A: Yes, Credit Karma has a user-friendly website that offers all the same features as the mobile app. You can access it from any desktop or laptop with internet connectivity. The website is designed to be intuitive and easy to navigate, allowing you to check your credit scores, review personalized recommendations, and explore financial services with the same ease as you would on the mobile app.

For more detailed information and to start leveraging the benefits of the Credit Karma app, visit Credit Karma’s official website. Whether you are using a mobile device or a desktop, the platform provides a comprehensive suite of tools to help you manage and improve your financial health.