When it comes to protecting your vehicle, choosing the right auto insurance is crucial. With so many options available, it’s essential to find a provider that offers comprehensive coverage, competitive rates, and exceptional customer service. In this article, we’ll explore how Erie Auto Insurance stands out in the crowded market and why getting an Erie auto insurance quote could be the best decision for car owners.

Toc

Understanding Erie Auto Insurance Quote

Obtaining a tailored quote for auto insurance is vital to ensure you get the best coverage at the most affordable rate. Erie Auto Insurance is known for its competitive rates and attractive discounts for safe driving. By providing tailored quotes, Erie ensures that each policy matches the unique needs of the individual, helping you save money while still getting high-quality protection. Getting an Erie auto insurance quote is a simple and efficient process that can be done online or through an agent. With just a few pieces of information about your vehicle, driving history, and personal details, you can receive a personalized quote in minutes.

Comprehensive Coverage Options

Erie Auto Insurance offers a range of coverage options to protect you financially in case of an accident or other unexpected events. These include liability coverage, collision coverage, comprehensive coverage, medical payments coverage, and underinsured/uninsured motorist protection. By customizing your policy with these options, you can ensure that you are fully covered for any potential risks while on the road.

Competitive Rates and Attractive Discounts

Erie’s competitive rates make it stand out among other auto insurance providers. The company prides itself on offering affordable coverage without compromising on quality. Additionally, Erie offers attractive discounts for safe driving, multiple policies, and more, making it possible for customers to save even more money on their premiums. These discounts are a testament to Erie’s commitment to providing value to its customers.

Key Benefits of Erie Auto Insurance

- Comprehensive Coverage: As mentioned earlier, Erie Auto Insurance offers a wide range of coverage options to protect you against various risks while on the road. This comprehensive coverage ensures that you are financially secure in case of an accident or other unforeseen events, such as theft, vandalism, or natural disasters. It is designed to give you peace of mind knowing that whatever happens, you’re covered.

- Competitive Rates: By offering competitive rates and attractive discounts, Erie makes it easy for car owners to get high-quality coverage without breaking the bank. In addition to standard discounts for safe driving and multi-policy bundling, Erie also provides special rates for young drivers, senior citizens, and vehicles equipped with advanced safety features. This makes insurance both affordable and accessible to a wide range of customers.

- Exceptional Customer Service: Erie is known for its exceptional customer service, with a team of knowledgeable agents always ready to assist customers with any questions or concerns they may have. Their customer service is not only responsive but also empathetic, ensuring that each customer feels valued and understood. Erie’s commitment to customer satisfaction has earned them high ratings and numerous awards in the insurance industry.

- Personalized Quotes: With tailored quotes, Erie makes sure that each policy matches the specific needs of the individual, providing the right coverage at the best price. They use a personalized approach to assess your unique situation, such as your driving history, vehicle type, and personal preferences, to create a policy that is just right for you. This personalized attention helps ensure that you are not paying for coverage you don’t need while still being fully protected.

High-Quality Coverage Options

Erie Auto Insurance offers coverage options tailored to meet individual needs, providing more comprehensive protection than many standard insurance policies. Whether you need basic liability coverage or full coverage with added protections like uninsured motorist coverage, rental car reimbursement, or roadside assistance, Erie has you covered. This extensive range of options ensures that you can customize your policy to fit your specific needs and lifestyle.

Award-Winning Customer Service

One of the standout features of Erie Auto Insurance is its award-winning customer service, which is available 24/7. This level of support and convenience sets Erie apart from competitors, ensuring that help is always just a phone call away. Their customer service team is trained to handle everything from simple inquiries to complex claims, making the process smooth and stress-free. The high level of customer care has made Erie a trusted name in auto insurance.

Access to Trusted Repair Shops

Through Erie’s Direct Repair Program, policyholders gain access to a network of trusted repair shops. This program ensures that you receive fast, reliable service when your vehicle needs repairs, giving you peace of mind during stressful times. These repair shops have been vetted for quality and reliability, ensuring that your vehicle is repaired correctly the first time. In addition to quick service, many shops offer warranties on their repairs, further enhancing the value of this benefit.

Customizable Policies

Erie allows for extensive policy customization. You can add options like rental car coverage, new car replacement, and pet injury protection, giving you the flexibility to create a policy that meets all your specific needs. This customization is a significant advantage for car owners looking for tailored coverage, as it allows you to build a policy that aligns perfectly with your life circumstances. Whether you’re a frequent traveler, a pet owner, or someone who commutes daily, Erie has options to ensure you’re adequately protected.

Comparative Analysis

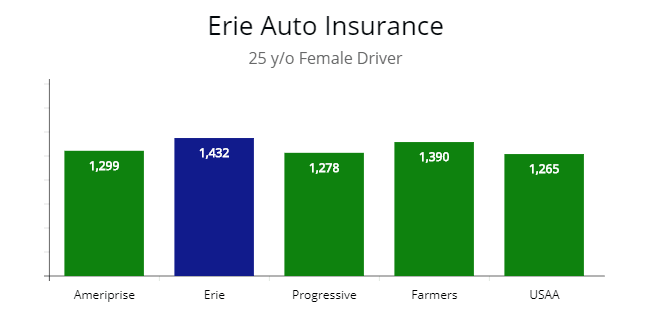

When comparing Erie Auto Insurance with other providers, it’s clear that the company stands out in terms of coverage options, competitive rates, and exceptional customer service. Customers can also benefit from a personalized approach to insurance policies and access to trusted repair shops through the Direct Repair Program. These advantages make Erie an excellent option for car owners looking for high-quality protection at affordable rates.

When compared to other auto insurance providers, Erie stands out in several key areas:

- Cost-Effectiveness: Erie offers competitive rates and various discounts for safe driving, making it a cost-effective choice for many car owners.

- Comprehensive Coverage: The high-quality coverage options provided by Erie are more robust and customizable than many standard policies offered by competitors.

- Customer Service: Erie’s 24/7 customer service is unmatched in the industry, ensuring that policyholders receive support anytime they need it.

- Repair Services: The Direct Repair Program gives Erie policyholders access to a network of reliable repair shops, a benefit not always available with other providers.

How to Obtain an Erie Auto Insurance Quote

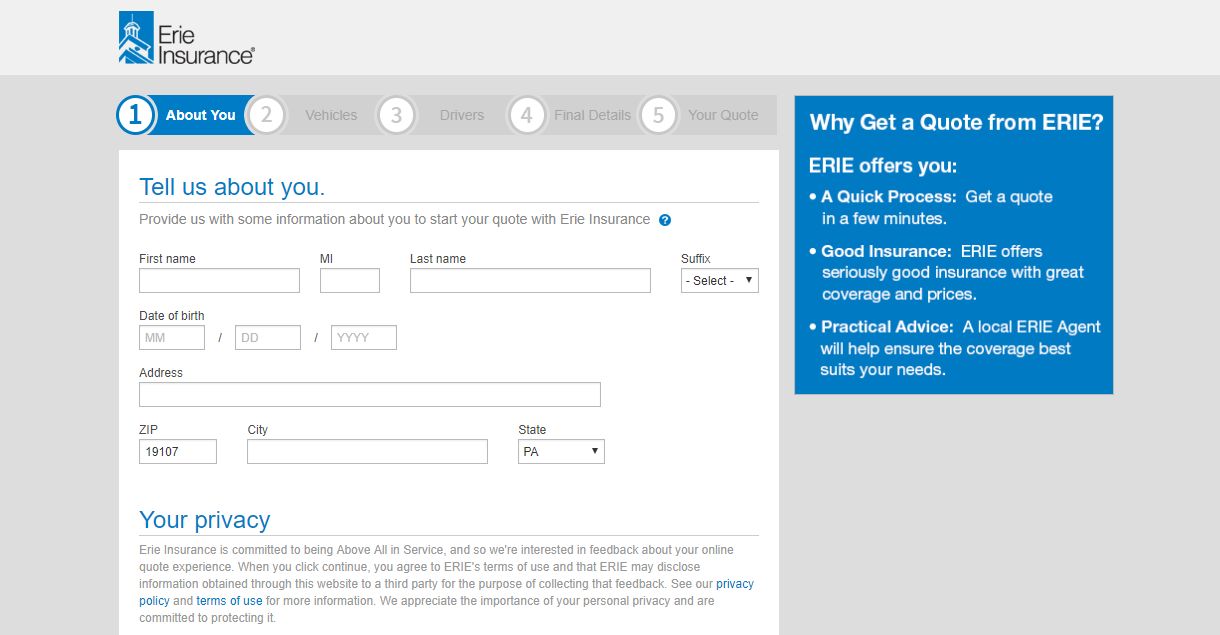

Getting a personalized Erie auto insurance quote is simple and convenient. Follow these steps to get started:

- Visit the Erie Insurance Website: Go to the Erie Insurance website and fill out the online quote form with your personal and vehicle information, including make, model, and year of your car, as well as your driving history and any additional drivers. This will allow Erie to tailor the quote to your specific needs and circumstances.

- Contact an Agent: You can also contact a local Erie insurance agent to discuss your needs and get a customized quote. Agents can provide personalized advice, explain the different coverage options, and help you understand how various factors like your driving record or vehicle type might affect your premium.

- Compare and Choose: Review the quote provided to you, compare it with other options, and choose the policy that best meets your needs. Consider factors such as coverage limits, deductibles, and any additional benefits or discounts that may be available, such as safe driver discounts or bundling options with other types of insurance.

- Finalize Your Coverage: Once you’ve selected your policy, complete the necessary paperwork to finalize your coverage. This may include providing additional documentation, setting up payment arrangements, and reviewing the policy details to ensure everything is correct.

Case Studies and Testimonials

To further illustrate the effectiveness of Erie Auto Insurance, here are some real-life examples and testimonials from satisfied customers:

Case Study 1

John, a 35-year-old professional, experienced a minor car accident in his sedan. Thanks to Erie’s 24/7 customer service, he was able to report the incident immediately and get his claim processed within a day. John was impressed by the efficiency and support he received, noting that the claims adjuster was not only prompt but also empathetic and thorough in explaining the next steps. Additionally, the recommended repair shop provided high-quality service, ensuring his car was back on the road quickly.

Case Study 2

The Garcia family, with two teenage drivers, sought affordable yet comprehensive auto insurance. Erie’s competitive rates and discounts for safe driving made them choose Erie. Over time, the family was able to benefit from Erie’s tailored coverage options and affordable premiums. The Garcias appreciated the flexibility of adjusting their coverage as their needs changed, such as adding roadside assistance and rental car coverage when their teenagers started driving more frequently.

Testimonial 1

“I’ve been with Erie for over 5 years. Their customer service is top-notch, and the rates are unbeatable. When my car needed repairs, the process was smooth and the repair shop they recommended was excellent. They even helped me arrange a rental car while mine was in the shop, which was a huge relief.” – Sandra M.

Testimonial 2

“Erie’s auto insurance has truly been a lifesaver for me. The customizations available in my policy, especially the pet injury coverage, have given me peace of mind during long road trips with my furry friends. I love knowing that my pets are protected just as much as I am.” – Alex T.

By following these steps and hearing from satisfied customers, you can see why Erie Auto Insurance is a trusted choice for many individuals and families.

Conclusion

Erie Auto Insurance offers a range of benefits that make it an excellent choice for car owners. From competitive rates and customizable policies to award-winning customer service and a trusted repair network, Erie provides comprehensive protection and peace of mind.

If you’re in the market for auto insurance, consider getting a personalized Erie auto insurance quote today. With Erie, you can rest assured that you’re getting high-quality coverage tailored to your needs. Don’t wait—take the first step towards better protection and peace of mind.

Learn more about Erie Auto Insurance and get your free quote today!