In the digital age, managing finances has never been more seamless and efficient. HSBC Internet Banking stands at the forefront of this revolution, offering consumers a secure, user-friendly platform to handle their financial needs from anywhere in the world. In this article, we’ll explore the key features, competitive advantages, and unique selling points that make HSBC Internet Banking an ideal choice for modern-day banking.

Toc

Introduction to HSBC Internet Banking

HSBC Internet Banking is designed to provide customers with secure online access to their banking accounts 24/7. Whether you’re at home, at work, or on the go, HSBC Internet Banking ensures that you have full control over your finances at all times. With a suite of features that cater to diverse financial needs, it offers a comprehensive and convenient banking experience. Let’s dive deeper into what makes HSBC Internet Banking a top choice for customers around the world.

Features and Benefits

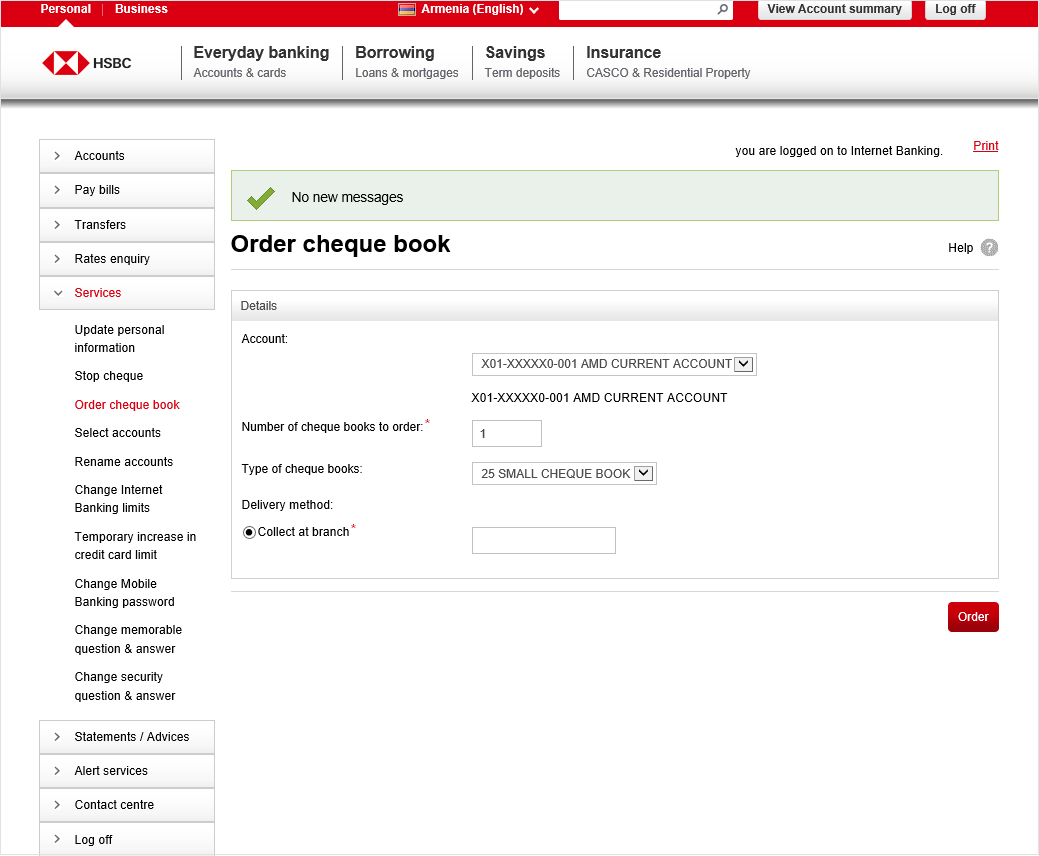

- Easy Navigation: HSBC Internet Banking boasts an intuitive interface that allows users to navigate through their accounts with ease. Whether you need to check your balance, transfer funds, or pay bills, everything is just a few clicks away.

- Secure Transactions: One of the biggest concerns when it comes to online banking is security. With HSBC Internet Banking, customers can rest assured that their transactions are safe and protected by advanced encryption technology.

- Real-Time Access: No more waiting in line at the bank or trying to catch customer service during business hours. With HSBC Internet Banking, you have real-time access to your accounts, allowing you to stay on top of your finances at all times.

- Multi-Currency Support: For customers who frequently deal with international transactions, HSBC Internet Banking offers multi-currency support. This feature allows for seamless and convenient currency conversions without the hassle of visiting a physical bank.

Competitive Advantages

In a highly competitive market, HSBC Internet Banking stands out as a leader in online financial management. Here are some factors that give it an edge over its competitors:

- Global Reach: With operations in over 64 countries and territories worldwide, HSBC is truly a global bank. This means that customers can access their accounts and make transactions from almost anywhere in the world.

- Customized Solutions: HSBC understands that different customers have different financial needs. With a variety of account types and customizable features, HSBC Internet Banking caters to individual preferences and offers tailored solutions.

- Seamless Integration: In addition to online banking, HSBC also offers mobile banking and other digital services. This seamless integration across platforms allows for an even more convenient and unified banking experience.

Unique Selling Points

HSBC Internet Banking has a few standout features that make it an attractive option for customers looking to manage their finances online:

- Global View and Global Transfer: This feature allows customers to view all their HSBC accounts from around the world on one screen and transfer funds between them with ease.

- Budgeting Tools: With HSBC Internet Banking, customers can set budgets, track expenses, and receive notifications when they are nearing their budget limits. This feature helps users stay on top of their spending and manage their finances more effectively.

- Virtual Assistant: HSBC Internet Banking offers a 24/7 virtual assistant service that can help customers with basic banking tasks and provide support whenever needed. This feature adds an extra layer of convenience and accessibility to the platform.

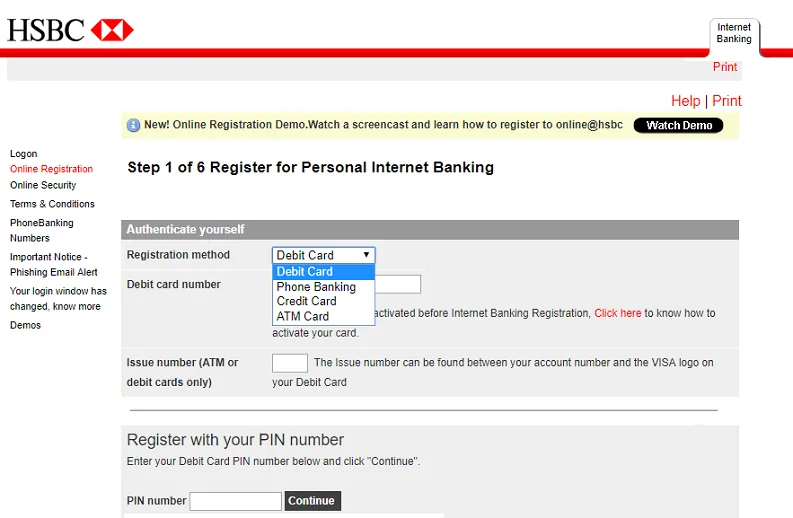

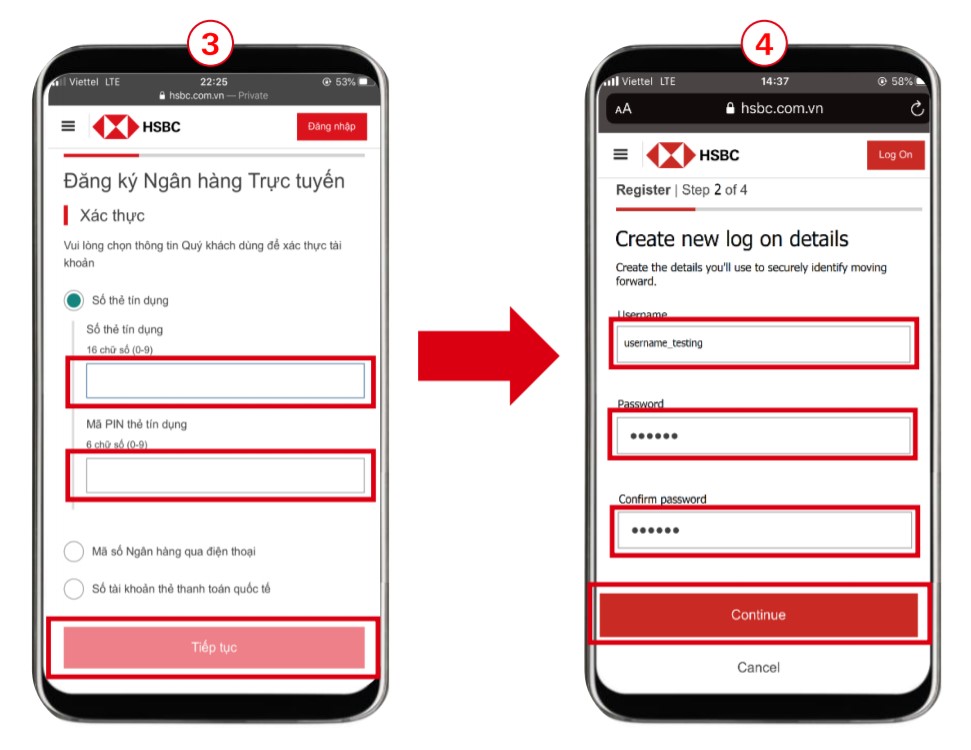

How to Sign Up for HSBC Internet Banking

Signing up for HSBC Internet Banking is a straightforward process designed to get you started swiftly and securely. Follow these steps to create your account and begin managing your finances online:

- Visit the HSBC Website: Go to the official HSBC website and locate the Internet Banking section. This can typically be found in the Customer Login or Internet Banking menu.

- Select ‘Register’: Click on the ‘Register’ or ‘Sign Up’ button to initiate the registration process.

- Provide Your Personal Information: Fill in the required fields with your personal details, including your full name, date of birth, and contact information. Make sure the information you provide matches the details linked to your HSBC account.

- Enter Your Banking Information: You will need to enter details such as your account number, debit or credit card number, and the security code from your card. This information helps HSBC verify your identity.

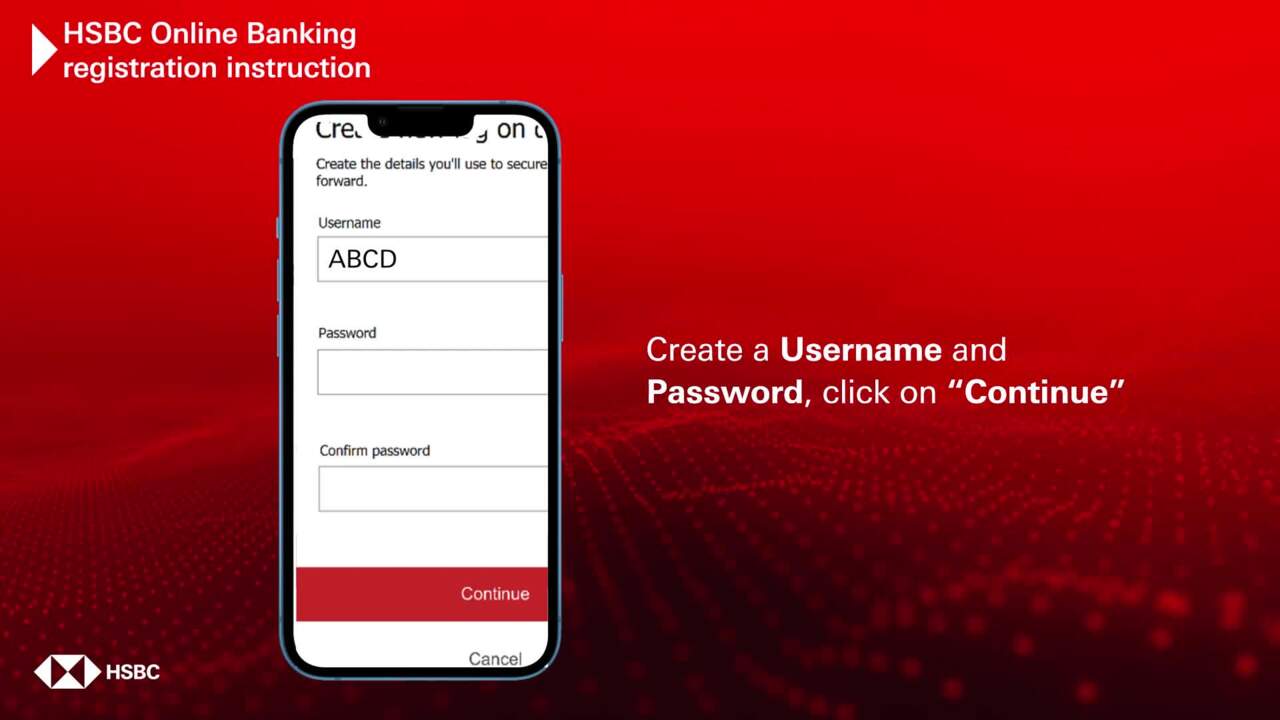

- Create a Username and Password: Choose a unique username and a strong password for your Internet Banking account. Ensure that your password includes a mix of letters, numbers, and special characters to enhance security.

- Set Up Security Questions: Select and answer a set of security questions. These questions will be used to verify your identity if you ever need to recover your account or reset your password.

- Review and Accept Terms and Conditions: Read through the terms and conditions carefully. Once you understand and agree to them, check the appropriate box and proceed.

- Confirmation and Activation: You may receive a confirmation email or text message with a one-time PIN to verify your registration. Enter the PIN where prompted to complete the sign-up process.

After successfully completing these steps, you will have access to HSBC Internet Banking, where you can enjoy the myriad of features designed to make managing your finances easier and more secure.

Security Measures in Place

Ensuring the security of your financial information is a top priority for HSBC Internet Banking. The platform employs multiple layers of security measures to protect customers against unauthorized access and potential cyber threats. Here are the key security features:

- Advanced Encryption Technology: HSBC uses robust encryption protocols to safeguard your personal and financial data. This means that any information transmitted between your device and the bank’s servers is encrypted and kept confidential.

- Two-Factor Authentication (2FA): To enhance security, HSBC Internet Banking requires two-factor authentication for account access and transactions. This typically involves a combination of a password and a one-time code sent to your registered mobile device, adding an extra layer of protection.

- Security Alerts: HSBC offers real-time security alerts to notify you of any suspicious activity or unauthorized attempts to access your account. These alerts help you take immediate action to secure your account if needed.

- Secure Login: The platform uses secure login methods, including personalized questions and CAPTCHA challenges, to verify your identity and prevent automated attacks.

- Biometric Authentication: For mobile banking users, HSBC provides the option to use biometric authentication methods such as fingerprint or facial recognition, making it easy and secure to log in to your account.

- Timed Logout: To prevent unauthorized access from unattended devices, HSBC Internet Banking automatically logs you out after a period of inactivity.

- Fraud Detection Systems: HSBC employs sophisticated fraud detection systems that monitor transactions for unusual or suspicious activity. Any anomalies are flagged, and appropriate measures are taken to ensure the safety of your account.

By implementing these robust security measures, HSBC Internet Banking provides a secure environment for you to manage your finances with peace of mind.

Mobile Banking Features

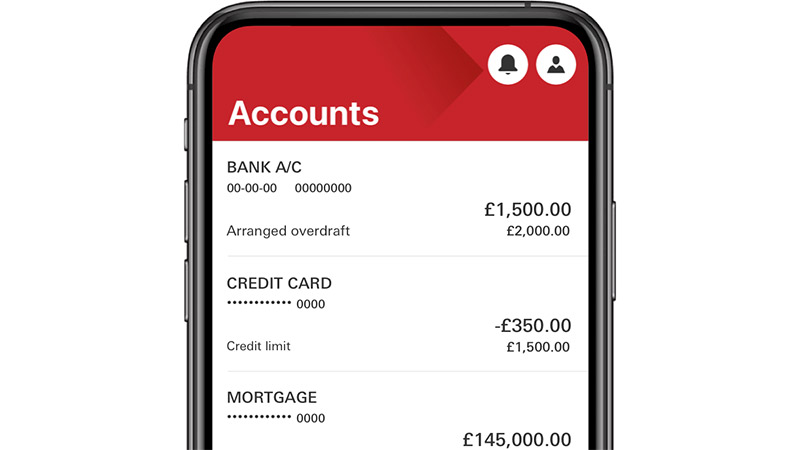

HSBC’s mobile banking app is designed to provide customers with a comprehensive and convenient banking experience on their smartphones and tablets. Here are some of the standout features that make HSBC mobile banking a preferred choice for on-the-go financial management:

- Account Management: Easily check your account balances, view recent transactions, and access detailed statements for all your HSBC accounts. The intuitive interface allows for quick and efficient management of your finances.

- Real-Time Transfers: Transfer funds between your HSBC accounts or to other banks in real-time. The app supports local and international transfers, making it simple to send money wherever it’s needed.

- Mobile Check Deposit: Deposit checks directly from your mobile device by taking a photo. This feature saves you a trip to the bank, providing a fast and secure way to deposit funds into your account.

- Bill Payments: Schedule and pay your bills directly from the app. You can set up recurring payments for regular bills and receive reminders to ensure you never miss a due date.

- Card Management: Manage your HSBC debit and credit cards within the app. This includes activating new cards, setting spending limits, reporting lost or stolen cards, and viewing transaction history.

- Personal Finance Tools: The app offers tools to help you budget, track your expenses, and manage your savings goals. You can create custom categories and set spending limits to stay on top of your financial health.

- Notifications and Alerts: Receive real-time notifications and alerts about your account activity, such as incoming deposits, low balances, and unauthorized transactions. Customize your notification settings to stay informed about what matters most to you.

- Biometric Login: For added security and convenience, the app supports biometric login methods like fingerprint and facial recognition, allowing you to access your accounts quickly and securely.

- Foreign Currency Exchange: Check live exchange rates and convert currencies directly within the app. This feature is especially useful for frequent travelers and those managing international finances.

- Secure Messaging: Communicate with HSBC customer service through the secure messaging feature. You can ask questions, receive support, and get updates on your inquiries without leaving the app.

- ATM Locator: Find the nearest HSBC ATMs and branches using the built-in locator feature. This helps you access cash and banking services wherever you are.

With these comprehensive features, HSBC’s mobile banking app offers a powerful and convenient way to manage your finances anytime, anywhere.

Comparison with Other Banks

When comparing HSBC with other prominent banks, several distinct advantages stand out that contribute to HSBC’s appeal. One of the primary differentiators is HSBC’s extensive global presence, operating in over 60 countries and territories. This international reach provides seamless banking experiences for globetrotters and expatriates, with easy access to local and international banking services.

Security and Technological Innovation: HSBC’s robust security measures, including advanced encryption, two-factor authentication, and biometric login options, are comparable, if not superior, to those offered by other leading banks. While many banks implement strict security protocols to protect customer information, HSBC’s multi-layered security approach, including real-time alerts and sophisticated fraud detection systems, sets it apart by providing a secure environment for all users.

Mobile and Online Banking: In terms of digital banking capabilities, HSBC’s mobile banking app offers a comprehensive suite of features that rivals those of other major banks. While competitors like Chase and Bank of America also provide robust mobile banking solutions, HSBC’s added focus on global services such as live currency exchange and international transfers gives it an edge for international users.

Customer Experience and Support: HSBC excels in providing exceptional customer service through various channels, including secure messaging within the app, which ensures personalized and convenient interactions. Although banks like Wells Fargo and Citibank also emphasize customer service, the ease of accessing HSBC’s global support network makes it superior for international customers.

Specialized Financial Services: Additionally, HSBC’s offerings in wealth management and personal finance tools stand out among competitors. With tailored services like foreign currency accounts and global investment opportunities, HSBC caters to the specific needs of international investors and high-net-worth individuals, areas where competitors may not provide as extensive an array of tailored solutions.

Comparatively, while banks like JPMorgan Chase and Bank of America hold significant market positions in the US, HSBC’s international footprint and specialized services make it a compelling choice for customers seeking a global banking partner with advanced security, convenient digital solutions, and attentive customer service.

Conclusion

HSBC Internet Banking offers a blend of security, convenience, and comprehensive financial management that is hard to match. With real-time transactions, easy bill payments, and seamless integration with other HSBC services, it provides a robust banking solution for consumers. The user-friendly interface and customizable alerts further enhance the experience, making it accessible and efficient for all users.

Ready to streamline your banking experience? Sign up for HSBC Internet Banking today and take control of your finances with confidence and ease. Visit our website or contact us directly to get started.

By embracing HSBC Internet Banking, you’re not just choosing a banking service; you’re opting for a smarter, more secure way to manage your financial life.