Dealing with multiple credit card debts can feel like juggling knives – one wrong move and the consequences can be severe. If you’re feeling overwhelmed by monthly payments, interest rates, and the never-ending debt cycle, credit debt consolidation might offer the reprieve you need. This comprehensive guide aims to shed light on credit debt consolidation, making it accessible and actionable for debtors looking to regain control of their financial health.

Toc

What is Credit Debt Consolidation?

Credit debt consolidation involves combining multiple credit card debts into a single payment. This can be achieved through a consolidation loan, balance transfer credit card, or a debt management plan, each offering unique benefits tailored to different financial situations. The goal is to simplify your monthly payments, secure a lower interest rate, and create a manageable path to paying off your debt. By consolidating your debts, you also have a clearer understanding of your financial obligations and can make more informed decisions.

Why Consider Credit Debt Consolidation?

Credit debt consolidation can be a helpful option for those struggling with multiple credit card debts. It allows you to streamline your payments and potentially save money on interest rates. Additionally, by consolidating your debts, you can often negotiate more favorable terms, such as lower monthly payments or extended repayment periods. This can provide much-needed relief for individuals facing financial difficulties.

How Does Credit Debt Consolidation Work?

The process of credit debt consolidation typically involves taking out a loan or transferring balances to a new credit card with better terms. With a consolidation loan, you borrow the amount needed to pay off all your existing debts and then make one monthly payment towards the loan. Balance transfer credit cards offer an introductory period with 0% interest, allowing you to transfer your existing credit card balances and pay them off without accruing additional interest.

Benefits of Credit Debt Consolidation

There are several benefits to utilizing credit debt consolidation for those struggling with multiple debts. One of the main advantages is simplifying your payments into one monthly bill, making it easier to manage and keep track of your finances. This can also help improve your credit score by reducing the number of accounts with outstanding balances.

Another benefit is potential savings on interest rates. If you have high-interest debts such as credit cards or personal loans, consolidating them into a lower interest loan can save you money in the long run. You may also be able to negotiate better terms, such as longer repayment periods or lower monthly payments, giving you more breathing room in your budget.

In addition, debt consolidation can also help with debt management and budgeting. By combining all of your debts into one, you can better plan and prioritize your payments. This can also make it easier to stay on top of due dates and avoid late fees or penalties.

However, it’s important to carefully consider your options before choosing a debt consolidation method. Some methods may require collateral or have high fees attached, so it’s essential to read the fine print and understand all terms and conditions before signing on. It’s also crucial to address the root cause of your debt issues, whether it be overspending or unexpected expenses, to prevent falling back into old habits.

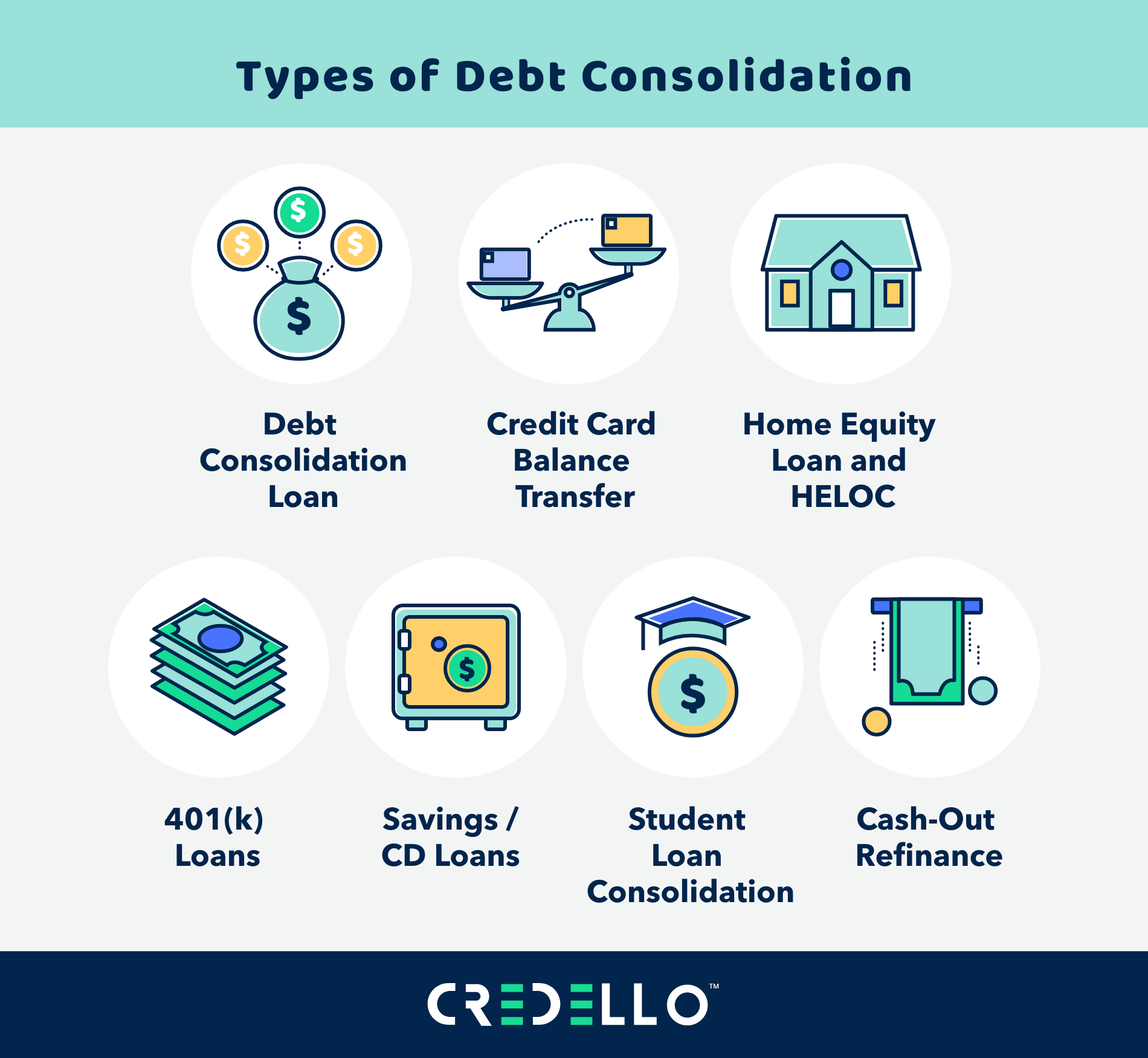

Types of Credit Debt Consolidation

1. Consolidation Loan

A consolidation loan is a personal loan used to pay off all your credit card debts, leaving you with a single monthly payment to the lender. This type of debt consolidation typically has a fixed interest rate, meaning your monthly payments will remain the same throughout the loan term. It also allows you to pay off your debts in full, potentially improving your credit score. However, it’s essential to carefully evaluate the terms and fees associated with a consolidation loan before committing.

2. Balance Transfer Credit Card

A balance transfer credit card involves transferring all of your credit card balances to a single new credit card with a lower interest rate. This can be an excellent option for those with good credit, as many balance transfer cards offer introductory 0% interest rates for a certain period. However, be mindful of the fees associated with balance transfers and make sure to pay off your entire debt before the promotional period ends.

3. Debt Management Plan

A debt management plan (DMP) involves working with a credit counseling agency to negotiate lower interest rates and monthly payments with your creditors. The agency acts as a mediator between you and your creditors, helping you create a realistic repayment plan based on your financial situation. While a DMP may not directly reduce the amount of debt you owe, it can make it more manageable and affordable.

Is Credit Debt Consolidation Right for You?

Before considering credit debt consolidation, it’s essential to evaluate your financial situation and determine if it’s the right solution for you. Consider the following factors:

- Total amount of debt: If you have a significant amount of debt, consolidating may help simplify your payments and potentially reduce interest rates. However, it’s important to ensure that the new monthly payment is manageable for your budget.

- Credit score: If your credit score has been negatively impacted by high credit card balances, consolidating and paying off your debts can improve it in the long run.

- Interest rates: One of the main advantages of debt consolidation is securing a lower interest rate. Evaluate the interest rates on your current credit cards and compare them to the rates offered by consolidation loans or balance transfer cards.

- Monthly payments: Consolidation aims to make your monthly payments more manageable. However, it’s crucial to ensure that the new payment is feasible for your budget and won’t cause further financial strain.

Why Consider Credit Debt Consolidation?

The appeal of credit debt consolidation lies in its promise to simplify your financial life. Here are several compelling reasons to consider this strategy:

- Single Payment: Consolidation replaces multiple bills with one monthly payment, making it easier to manage your finances.

- Lower Interest Rates: Ideally, consolidation leads to lower interest rates, reducing the amount of money you pay over time.

- Debt-Free Plan: It offers a clear timeline for debt repayment, helping you stay focused and motivated.

How to Achieve Successful Credit Debt Consolidation

.1. Assess Your Debt

Begin by taking a comprehensive look at your debts – this means identifying all your creditors, noting down the interest rates, monthly payments, and due dates for each. Having a clear overview of your financial obligations is the first critical step in determining the most effective consolidation method tailored to your situation.

2. Explore Your Options

You have several strategies at your disposal for consolidating debt:

- Consolidation Loan: This involves obtaining a single loan to pay off multiple debts, which simplifies your payments to just one loan with potentially lower interest rates. You can look into financial institutions, credit unions, and online lenders as potential sources for a consolidation loan.

- Balance Transfer Credit Card: For those with high-interest credit card debt, transferring the balances of multiple cards to one card that offers a low or 0% introductory interest rate can be a smart move. This method works best for individuals who are disciplined and confident in their ability to pay off the balance before the promotional interest rate period expires.

- Debt Management Plan: This plan involves working with a credit counseling agency which will negotiate with your creditors to potentially lower your interest rates and agree on a manageable repayment plan. Under this plan, you make single monthly payments to the credit counseling agency, which then distributes the funds to your creditors on your behalf.

3. Consider the Costs

While debt consolidation can offer significant savings on interest payments over the long run, it’s important to be mindful of any fees that might be associated with your chosen method. This includes balance transfer fees for credit cards, loan origination fees for consolidation loans, and possibly monthly service fees if you opt for a debt management plan. Weighing these costs will help you make a more informed decision.

4. Check Your Credit Score

Understanding your current credit score is crucial as it significantly influences your eligibility for certain consolidation methods, particularly consolidation loans and balance transfer credit cards. A higher credit score can qualify you for better interest rates and terms, so knowing where you stand can guide you toward the most realistic and beneficial options.

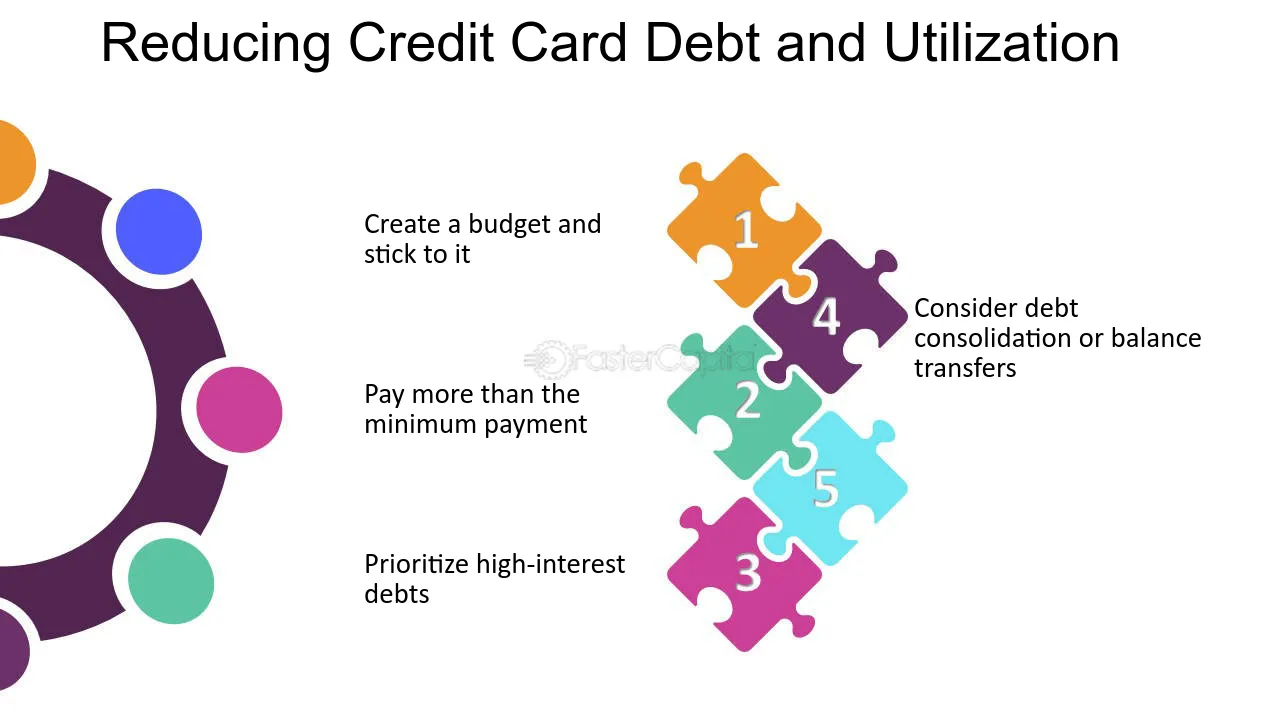

5. Make a Plan and Stick to It

Successfully consolidating your debt is just the beginning. The next crucial step is to devise a solid budget and repayment strategy to avoid falling back into debt. This means not only focusing on repaying the consolidation loan or balance transfer credit card but also being mindful about not accruing new debts. If you’re on a debt management plan, it’s imperative to adhere to the agreed-upon monthly payments and maintain regular communication with your credit counseling agency to stay on track.

By thoroughly understanding each step and carefully planning your approach, you can navigate the process of debt consolidation more effectively, setting yourself on a path to financial stability and peace of mind.

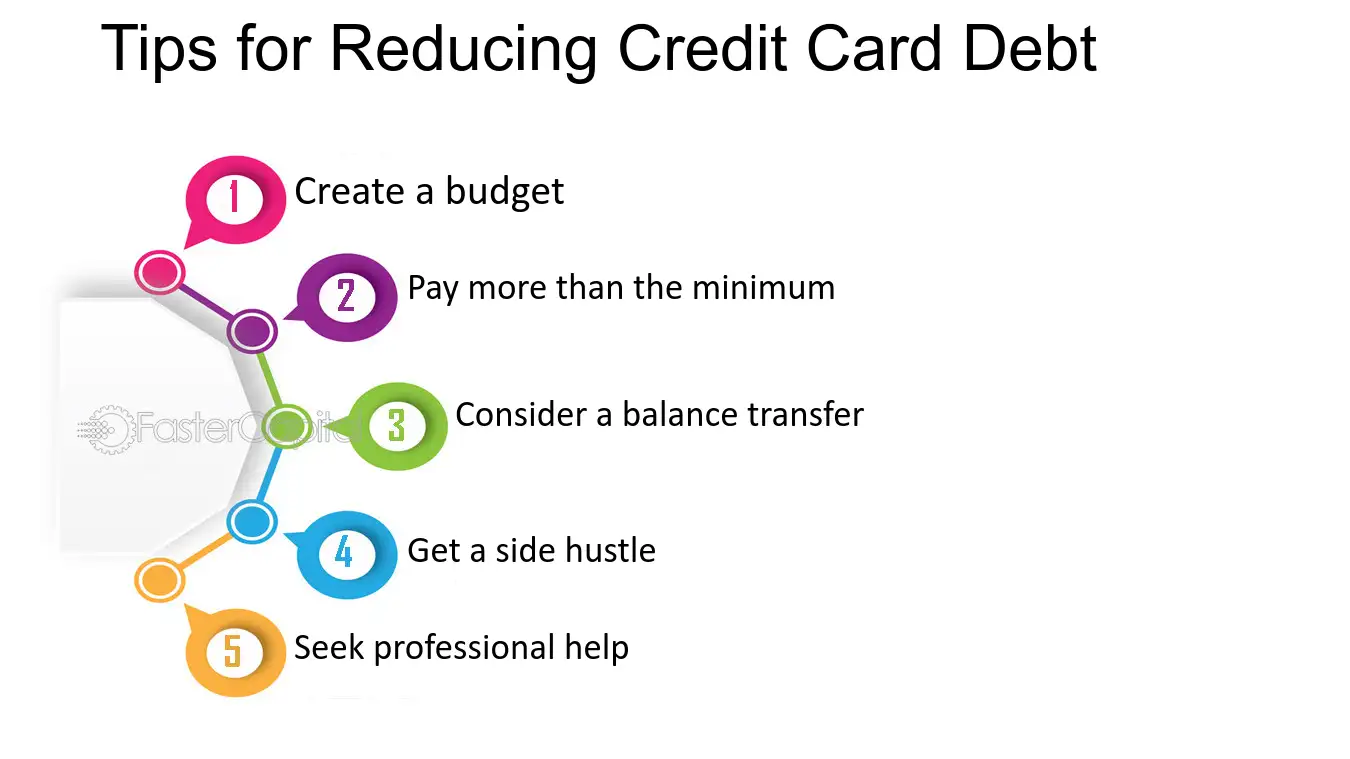

Tips for Successful Credit Debt Consolidation

Here are some practical tips to ensure successful credit debt consolidation and maintain financial health.

Tips for Successful Credit Debt Consolidation

- Maintain Discipline with New Credit: After consolidating your debt, it’s crucial to avoid the temptation of using your newly freed-up credit cards, which could lead you back into debt.

- Budget Wisely: Create and stick to a realistic budget that allocates funds for your consolidation loan payments and minimizes unnecessary expenses. This approach will help you stay on track and possibly pay off your debt faster.

- Communicate with Your Lender: If you face financial difficulties during your repayment period, promptly communicate with your lender. Many lenders are willing to work with you to find a solution, rather than seeing you default on the loan.

- Monitor Your Credit Score: Regularly check your credit score to understand the impact of your debt consolidation efforts. Improvements in your score can motivate you to continue your debt-free journey.

- Seek Professional Advice: Don’t hesitate to seek advice from financial advisors or credit counseling services. Professional guidance can provide valuable insights and strategies tailored to your specific financial situation.

- Celebrate Milestones: Acknowledge and celebrate when you reach significant milestones in your debt repayment plan. These celebrations can boost your morale and commitment to becoming debt-free.

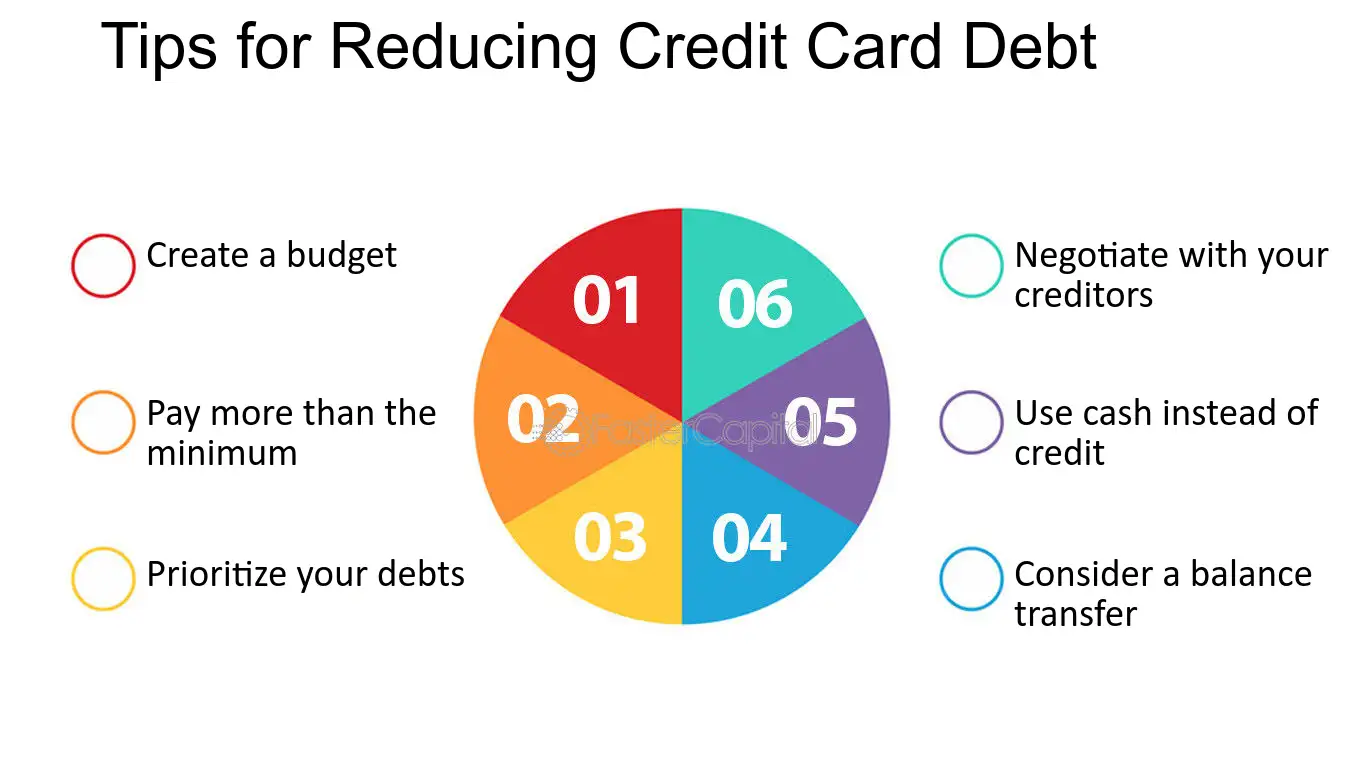

Negotiating with Creditors

Negotiating directly with your creditors can be an effective way to potentially lower your interest rates, reduce your monthly payments, or even have some of your debt forgiven. Here are a few tips to help you successfully negotiate with creditors:

- Be Prepared: Before reaching out, gather all relevant information about your debts, including the total amount owed, interest rates, and your current financial situation. Presenting a clear picture of your finances can help during negotiations.

- Contact the Right Department: Make sure you’re talking to someone who has the authority to make decisions or changes to your account. This is often the hardship department or customer service.

- Explain Your Situation: Be honest about your financial struggles and express a sincere desire to pay off your debt. If appropriate, mention any extenuating circumstances like job loss, medical issues, or other financial hardships.

- Ask Specific Questions: Inquire about possible options such as interest rate reductions, payment plans, or waiver of late fees. Be clear about what changes would help you manage your debt better.

- Be Polite but Persistent: Maintain a respectful tone, but don’t be afraid to ask for a supervisor or make multiple calls if necessary. Sometimes, persistence is key to getting a favorable response.

- Get Everything in Writing: Once you’ve reached an agreement, request a written confirmation detailing the terms. This documentation is crucial for avoiding misunderstandings later on.

Remember, while not all creditors will be willing to negotiate, many prefer to work with you rather than risk default or the costs associated with debt collection. It’s always worth reaching out and exploring your options.

While credit debt consolidation has its advantages, it’s important to be aware of potential challenges that can undermine its benefits

- Increased Debt Risk: Consolidating debt can free up credit lines, which might tempt some individuals to accrue additional debt, thereby worsening their financial situation.

- Longer Repayment Periods: Some consolidation methods, especially those with lower monthly payments, can extend the repayment period. This might result in paying more interest over the life of the debt.

- Qualification Requirements: High credit score and stable income requirements can make it difficult for those in significant debt or with poor credit history to qualify for certain consolidation loans or balance transfer credit cards.

- Upfront Costs: Fees associated with debt consolidation, such as balance transfer fees or loan origination fees, can add to the overall cost, potentially offsetting the savings gained from lower interest rates.

- Impact on Credit Score: Applying for new loans or credit cards for consolidation purposes can lead to hard inquiries on your credit report, temporarily lowering your credit score.

Understanding these challenges is crucial for anyone considering debt consolidation as a strategy for managing their finances. It’s important to carefully evaluate your situation and consider whether the benefits of consolidation outweigh these potential drawbacks.

Conclusion

Credit debt consolidation can be a lifeline for those drowning in multiple debt payments. By assessing your debt, exploring consolidation options, considering the costs, checking your credit score, and committing to a repayment plan, you can simplify your financial life and work your way towards freedom from debt.

Remember, while credit debt consolidation can offer a fresh start, it’s ultimately up to you to maintain disciplined financial habits. With the right approach, you can tackle your debt head-on and set yourself up for a more secure financial future. So, it’s important to continue monitoring your spending and budgeting carefully even after consolidating your debt. And if you encounter any difficulties, don’t hesitate to seek help from a credit counseling agency or reach out to your creditors for assistance. With determination and perseverance, you can overcome your debt and achieve financial stability. Keep working towards your goals and maintaining healthy financial habits, and you’ll soon be on your way to a debt-free life. So, don’t let the challenges discourage you; instead, use them as motivation to stay committed to your goal of becoming debt-free. With patience and diligence, you can take control of your finances and achieve financial freedom.